How will each sector fare in 2012?

What lies ahead for each sector of the industry this year? Christie & Co's Business Outlook 2012 looks at the key finds and predictions

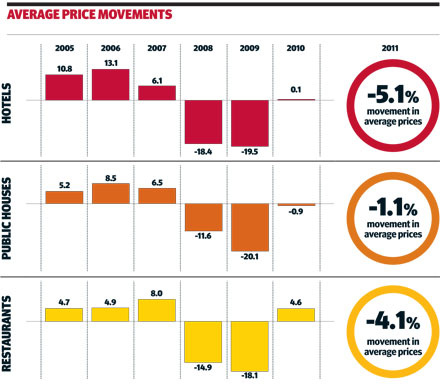

The average price of hospitality business property fell back in 2011 after hints of a rally in 2010, but there were still positive signs of demand for property outstripping supply.

That was one of the key findings of Christie & Co's Business Outlook 2012. There was a marginal increase of 0.3% among the hospitality, leisure, care and retail sectors in 2010, but prices dropped by an average of 2.48% in 2011.

But there was a significant increase in the quantity of offers made for businesses, particularly in the hotel sector, where the number of done deals also increased.

Chairman of Christie & Co, David Rugg, said: "Twelve months ago, not even the gloomiest forecaster would have predicted the depth of the recession, nor the extent of the crisis engulfing the financial markets, particularly across the Eurozone."

Administrator-led business sales were more common during 2011, but Rugg said the fact that the market was able to absorb the number of businesses for sale was a sign that the market mechanism remained as effective as ever.

Looking ahead, Rugg said he expected there to be an increase in opportunities and transactions, especially as banks and their customers disposed of more assets to reduce their gearing.

Hotels

The hotel sector started 2011 with high hopes but was repressed by a lack of debt finance and ongoing economic uncertainty. The market was also divided between London, which fared relatively well, and the rest of the country.

Jeremy Hill, director and head of hotels at Christie & Co, said deal activity was typified by a "flight to quality" by investors, highlighted by huge interest in the sale of von Essen hotels by Christie & Co on behalf of the administrators.

The small pipelines of new hotels are expected to lead operators to reap the reward from a decline in competition, but Christie & Co warned that capital expenditure would be key to maintain quality. Hill also expected the short-term boost of the Olympics, the Farnborough International Airshow and the Queen's Diamond Jubilee to be offset later in the year.

Christie & Co's predictions for the hotel sector in 2012

â- Investment will come from new markets including China, India and Russia, but will be London-centric

â- Banks may seek to rationalise their investments

â- Transactional market likely to remain cautious; prices will be driven by those able to buy now

â- Regions will see continued variable trading, but may be boosted by Olympic "stay-aways"

â- Capital expenditure timebomb will hit owners and force down prices on tired assets

Pubs

More pubs sold in 2011 stayed as pubs (64%) than was the case in 2010 (60%), and average prices dropped 1.1%, compared with an average of 2.48%.

Neil Morgan, head of pubs at Christie & Co, said: "Though clouded by the general economic malaise, 2011 has given the pub sector grounds for optimism, with average prices holding up and increasing numbers of pubs staying as pubs after being sold. Moreover, of those pubs that do close, we are reassured by a growing number that are retained for some leisure use, such as restaurants."

Christie & Co's predictions for the pub sector in 2012

â- Banks will release further assets to the market

â- Over 2,000 pubs will be sold by the pub companies

â- Managed public house stock will continue to be in high demand

â- The late night sector will remain extremely challenging

â- The free house sector will grow by at least 1,000

â- There will be continued private equity interest in the managed house sector and emerging interest in the tenanted sector

Nightclubs

Nightclubs had another tough year, with high profile administrations of firms like Luminar Leisure. But Jon Patrick, director and head of leisure at Christie & Co, said nightclubs could overcome tough trading with some "out-of-the-box" thinking, and some clubs could relocate to smaller or city centre premises, or improve trading by making better use of the space across the week.

Christie & Co's predictions for the leisure sector in 2012

â- Across all parts of the leisure sector, value for money will be crucial

â- We should expect further distress in the nightclub and late night leisure sector, as youth unemployment continues to erode the target market

By Neil Gerrard

E-mail your comments to Neil Gerrard here.

Catererandhotelkeeper.com jobs

Looking for a new job? Find your next job here with Catererandhotelkeeper.com jobs