Regional hotel property focus- Manchester

Manchester has the UK's second largest concentration of people and businesses and is the largest city and powerhouse of the North West. It's a commercial centre, home of regional government, finance, media and public administration, as well as housing large parts of the BBC and ITV - all of which are important generators of business travel.

Data from the AM:PM Database shows some 14,800 rooms in 140 hotels, with a third of supply in the budget sector and a third in the four-star segment. In terms of new supply, around 700 rooms are set to open this year and a further 1,150 in 2015 and 2016. There are more than 4,000 speculative rooms in the pipeline too - more of which are likely to come to fruition as the economic and property recovery strengthens.

Football will continue to underpin the appeal of the city for leisure visitors and corporate entertaining. The sector is performing so well that it has even attracted a former footballer to turn his hand to property development. Gary Neville's Hotel Football is currently being built near Old Trafford, and is one of the four-star hotels due to open later this year.

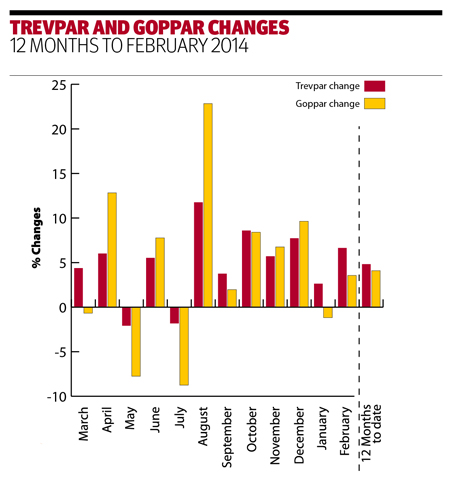

Manchester's strong and varied corporate and events-driven demand means a volatile trading pattern, but overall this translates into strong trading. According to the latest HotStats hotel market data, in the 12 months to February 2014, Manchester hotels saw high occupancy levels (up 1% to average almost 79%) and strong ARR (up 5% to £78) and revpar was up 6% to £61.39. Gross operating profit per available room (goppar) is also running ahead by 4% for the same period.

The momentum of last year is expected to continue and strengthen this year and beyond with further economic recovery for the North West and the UK in 2014 and 2015.

Liz Hall, head of hospitality and leisure research, PwC

Manchester Supply, pipeline and transactions

In the late 18th century, Manchester was regarded as the world's first industrialised city, but by the mid-20th century, its importance had declined. However, the last few decades have witnessed a successful renaissance that continues to transform the city and the wider greater metropolitan area.

Most economists regard Manchester as the second most influential city in the UK after London, but many Manchester natives would strongly dispute that. It is exactly this level of self-belief and long-term vision from developers, such as Peel, Bruntwood and Ask, that has positively influenced the Manchester we know today and will shape its future. Developments such as Spinningfields, Media City, the soon-to-be Airport City and potentially HS2 continue to shift its centre of gravity.

Over the past decade, a steady new supply of about 500 rooms has been absorbed each year. Room supply has risen by 20% in the past five years to its current tally of just under 15,000, and more than half of this is situated within one mile of the city centre. The main new openings in the past year have been the 63-apartment Saco Piccadilly and the 157-bed Travelodge Piccadilly.

Manchester offers a good spread of hotels across all quality points, with an inherent city centre polarisation towards budget and four-star. Over 80% of rooms in the city are branded. The average size of hotel - 106 bedrooms - is the largest of all major UK cities. There are also 25 hotels with over 200 bedrooms each, which ensures a highly focused community of general managers.

Numerous active pipeline hotel projects are under way that will add around 1,900 rooms or over 12% to room supply over the next two to three years. These include the 138-bed

Hotel Football, the 143-bed Premier Inn Salford Central and the 208-bed INNSIDE by Melia, all scheduled to open in 2014.

Looking ahead to 2015 and beyond, major new openings include at least two IHG-branded hotels (Holiday Inn and Hotel Indigo, possibly followed by a Crowne Plaza and Staybridge Suites), at least one Motel One, a first non-airport location for Yotel and several boutique properties, including Hotel Gotham from Bespoke Hotels.

Alan Gordon, director, AM:PM

Manchester hotel supply by category/grading

| - | Hostel | Apartments | Budget | 2-star | 3-star | 4-star | 5-star |

| Hotels | 5 | 18 | 41 | 25 | 23 | 25 | 2 |

| Rooms | 146 | 950 | 5,068 | 569 | 2,793 | 4,839 | 428 |

Football and shopping draw in visitors

With a 78% occupancy rate, Manchester outperforms the UK average and is seen increasingly by investors as an alternative to London.

The city has seen phenomenal growth over the past 20 years and it provides world-class facilities across a spread of industries, from financial and professional services to life sciences and biomedical research.

The city population swells regularly with a huge influx of visitors who come to watch the two Premier League and Champions League teams, or to attend major events such as the Labour and Conservative party conferences.

Trips for shopping, both in the city centre and the Trafford Centre, also draw leisure visitors. Fast road and rail connections and an expanding airport provide hoteliers with unrivalled access to international markets. So it is not surprising that investor confidence is high. The total number of hotel rooms will grow by 12% over the next few years, while established hoteliers continue to refurbish and upgrade their existing assets.

Hotel development is well and truly apace with flagship schemes such as First Street North and the planned Motel One in Piccadilly, which JLL advised on. The forward-thinking city council is an enabler of hotel development, while the existing market encourages new entrants, attracted by higher occupancies.

Hotel supply is dominated by the big hotel players, reflecting the drive behind the market for corporate and loyalty card programmes. The economy also attracts many contract workers, with an increasing demand for extended-stay accommodation.

Several hotels have changed hands over the past year, including the Premier Inn Manchester City Centre (CBRE Global Investors and Etrop Grange (Squire Hotels). Meanwhile, JLL sold Marriott Victoria & Albert (Westmont). The Macdonald Townhouse is also on the market.

Private and independent hoteliers will have to stay at the front of developments in social media and mobile websites to ensure market share is maintained. Capital expenditure is another fundamental area for investment to help offset increased competition from the new-build hotels.

Alistair Greenhalgh, vice president, Jones Lang LaSalle Hotels & Hospitality Group

| Upmarket hotel brands | Hotels | Rooms |

| Crowne Plaza | 2 | 522 |

| Hilton | 2 | 509 |

| Macdonald Hotels | 2 | 423 |

| Bewleys Hotels | 1 | 365 |

| Marriott | 2 | 363 |

| Midmarket hotel brands | Hotels | Rooms |

| Britannia Hotels | 4 | 1,053 |

| Holiday Inn | 3 | 383 |

| Mercure | 1 | 280 |

| Jurys Inn | 1 | 265 |

| Park Inn by Radisson | 1 | 252 |

| Budget hotel brands | Hotels | Rooms |

| Premier Inn | 17 | 2,188 |

| Travelodge | 9 | 1,121 |

| Holiday Inn Express | 5 | 755 |

| Ibis Budget | 2 | 360 |

| Ibis | 2 | 253 |