What 2017 holds for hospitality property

Simon Chaplin, head of restaurants, Neil Morgan, managing director of pubs and restaurants, and Barrie Williams, managing director of hospitality, all of Christie & Co, tell Neil Gerrard what they think the year will hold

Restaurants

This could be the year when we see one or two well-known restaurant chains fail, according to Simon Chaplin.

This time last year, Christie & Co predicted that there would be no chain casualties in 2016, but that the axe would fall in 2017 as businesses grappled with rising costs. That prophecy certainly held good for the most part of last year, with Ed's Easy Diner falling into administration at the end of 2016.

Judging by news early in 2017, that Jamie's Italian was to close six restaurant sites, it looks likely to continue to be accurate. The top four or five companies in the sector should be safe, Chaplin tells The Caterer, with the manoeuvrability to dispose of a few sites and maintain the rest, should they need to. However, other established brands could find themselves struggling, especially if they have chased growth and opened in marginal locations.

"They will be coming to the end of rent-free periods and maybe won't see the level of growth they wanted to, and there are two or three that will have a tough time. It will be in the smaller, mid-market area," Chaplin says.

Certainly, established brands will have to refresh their offer frequently to stop customers becoming bored, and whereas in previous years it has been the branded operators squeezing out the independents, that process may be slowing.

"In 2016, we saw private equity invest in a number of smaller brands as they look to find the next big thing and this is likely to continue in 2017. They are up against the Instagram generation seeking the hottest trends and 'fashion food' - a good social media presence and a different idea is good enough to drive footfall, but sustaining this brings more challenges, which operators need to find ways to combat," Chaplin adds.

Hotels

It was a year of two halves in 2016, according to Barrie Williams, Christie & Co's managing director of hospitality. The first six months were quiet, as everyone got nervous in the lead up to Brexit and then put their tools down post-Brexit. But that contrasted with a strong Q3 and a very strong Q4.

While there were few large investment deals over the period, there were several smaller portfolios of hotels on sale and single asset sales in the regions. An example was the sale in April 2016 of a collection of six Hilton managed regional properties, offered on a whole, sub-group or individual sale basis for a combined asking price of around £40m.

In the end, each of the six hotels, located in Basingstoke, Bromsgrove, Dunkeld, Newbury, Newport and Swindon, went to individual buyers.

"Where the big private equity houses built their platforms, what we have seen now is them divest parts of those portfolios that don't naturally fit with what they want to do going forward," Williams explains. "That's why you end up selling a group of six hotels but they go to six individual buyers. The reason it has changed and the reason that the prices have stayed up again in 2016, although admittedly lower than previously, is because it is a new type of investor. We have had high-net-worth individuals, hotel family funds, hotel institutional funds, all keen to buy single assets in the right locations for them, and I am talking assets of about £5m-£15m."

Bigger asset transactions could well start to take place in 2017, according to Williams, as major deals that stalled in 2016 get moving again, but mostly 2017 is expected to be very similar to 2016, with a number of single asset regional transactions in the pipeline.

Asian investors are expected to grow in importance as buyers of UK hotels both in London and in the regions. This has been helped along by the weakening in the value of the pound and the fact that Asian investors see the UK market as stable and safe.

"China, Hong Kong, Singapore, Malaysia, Thailand are all very different. Within those countries you have to understand high-net-worth individuals, insurance companies, an institutional fund and a state-owned enterprise - all of which are very different. So trying to understand who is the right party in Asia to buy the asset you have is pretty difficult.

"What is easy to understand is that they have got a lot of appetite to get money out of Asia and put it into what they perceive to be a safe haven, a stable economy; an ability to buy freehold, which they have no concept of in their own countries."

To that extent, Williams says, Brexit could spell reasonably good news - a point reinforced by political commentator Andrew Neil, who presented the launch of Christie & Co's Business Outlook 2017 last month - in the sense that some of the largest economies and governments in the world have been trying to devalue their currencies, and the UK has achieved that rapidly through the referendum on Brexit. "It is a benefit and we are the envy of the world in some respects," Williams says.

Hotel property prices may still be some way off their peak: "If you look back over the years and certainly at revenue per available room and to a certain extent gross operating profit per available room and you deal with inflation, we are still not back to the 2006/07 numbers.

We are probably still 10%-15% below those numbers, which gives you hope there is still some growth in real terms in revpar. However, I am not the biggest fan of revpar as the sole measure. You have to look at the bottom line and the costs affecting the overall business," Williams says.

Pubs

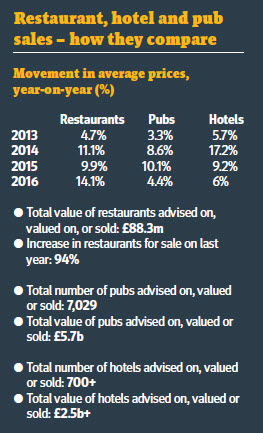

It was a subdued year for pub property transactions in 2016, and although prices rose by 4.4%, the supply of pubs to the market was relatively limited, thanks in part to the issues surrounding the introduction of the Market Rent Only (MRO) option, which allows the granting of a free-of-tie rent and an ending of all product and service ties when the tenant or lessee of a tied pub requests it.

"I think the industry as a whole was expecting a floodgate of applications to go to the free-of-tie option prior to the MRO being issued," Neil Morgan, managing director of pubs and restaurants at Christie & Co, explains.

"The reality is there was more of a trickle, the reason being that pubcos have adapted by offering more flexible lease terms, shorter terms, varied agreements, and probably giving better discounts to tenants to keep them."

Pubs also suffered from a pre- and post- Brexit hangover, which meant that the early part of the year was quiet. However, there was a flurry of deals in the latter, including Caledonia Investments agreeing to pay £116m for Liberation Group; the sale of the Chapman Group to Dominion Hospitality; the purchase by Stonegate Pub Company of Intertain, the owner of the Walkabout chain of bars, from Better Capital; and at the very end of the year, Punch Taverns agreed a takeover bid from Heineken that values the business at £403m.

Private equity businesses will continue their interest in the sector, Morgan predicts, and because the number of smaller multiple operators owning three or more pubs has risen steadily from 300 to up to over 500, there is likely to be acquisition and consolidation.

The quality of the UK pub estate is, in Morgan's estimation, healthier than it was, albeit leaner at 49,000 pubs across the country than 57,500 in 2007. Christie & Co's distressed asset sales in 2016 were down by 23% on 2015. Meanwhile, there was an 8% rise in the number of first-time entrants coming into the pub market.

Pubs are having to realign some of their sites to be more food-led, in line with customer expectations. Nonetheless, operators did find 2016 difficult, with the average cost of running a pub at a seven-year high and payroll costs accounting for almost 30% of turnover, according to the ALMR Christie & Co Benchmarking

Report. The National Living Wage and the National Minimum Wage will add to

operators' running costs, and they will need to continue to find ways to adapt to this.

Food price inflation

One of the unwelcome effects of Brexit is a rise in price of foodstuffs, thanks to a weakened pound. Undoubtedly, this will pose a challenge, but canny businesses would find ways around it, Chaplin says.

"Clever operators will look at their margins and look to source their products locally to nullify that effect," he says. "I have already had a couple of conversations with people who are looking to 'Britishise' their menu. Others will try to cut down their portion sizes slightly so they don't have to have a great leap in prices.

"At the fine-dining end of the market, it may be more difficult not to import a lot of product and those operators will have to find a way. It is just that initial impact and working out how you are going to deal with it."

Business rates change

As well as Brexit, price inflation, the National Living Wage and many other issues, hospitality businesses have also found themselves grappling with a revaluation of business rates, set to come into effect on 1 April 2017.

It is still difficult to determine exactly what the impact of the rate revaluation is likely to be, not least because so many businesses are appealing their rates.

Chaplin remarked that Christie & Co, whose ratings team offers support on the matter, has seen everything from corporate clients who are expecting to see a fall in the rates that they pay right up to some who have see a 400% rise.

The appeals process can go on for some time and so it may take a while before the impact of the revaluation can be assessed. In the meantime, Chaplin advises that operators should act quickly if they don't agree with a rate revaluation.

"All you know at the moment is your rateable value and how much you are going to be paying, but you need to act early and put your stall out and say if you don't agree with your rateable value."