Hospitality Business Leaders 2019: Explaining the optimism gap

The saying goes that the world is split between optimists and pessimists. You can be one or the other but rarely both and certainly not at the same time about broadly the same issue.

And yet that's what The Caterer's Hospitality Business Leaders 2019 report, powered by CGA, appears to reveal when it comes to how optimistic operators feel about the prospects for their own business and the market they operate in.

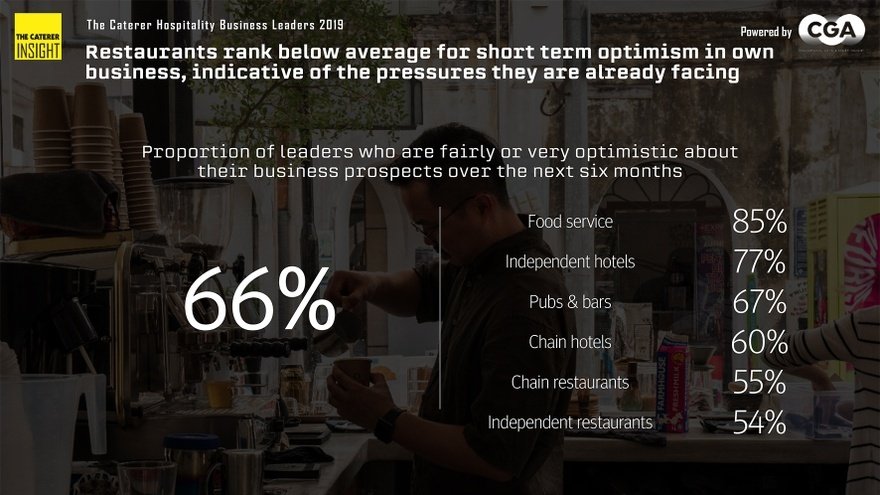

When asked to look ahead six months, 66% of the 500 business leaders quizzed declared themselves optimistic about the prospects for their business, but only 50% felt the same about the wider market – a 16 percentage point gap. Looking forward 12 months, that gap extended to 17 percentage points, with 70% confident in their own company but only 53% optimistic about the wider sector. What could account for the difference?

It's a gap that has only emerged relatively recently, in the aftermath of the Brexit referendum, says CGA vice president Peter Martin. "Pre-Brexit it wasn't like that because confidence in the pub and restaurant sector were both incredibly high. It took a real tumble three years ago but not to the same level and this gap has appeared," he says.

On the face of it, hotel industry consultant Melvin Gold regards the discrepancy between the figures as surprising. "There is a connection between one's own business and the market, and even for a business that is outperforming, there is a stark difference there," he observes.

Nonetheless, he sees potential reasons to explain the gap. First of all, consumers often express caution about their spending in the face of uncertainty but will eventually spend if their situation remains unchanged, which may explain why gloomy estimations of sentiment are not necessarily translating into lower business performance. "Even where consumer confidence is low, people will only hold back for so long before they ask themselves if they really are going to miss their summer holiday simply because they feel uncertain. If their job and income feels secure, they will often book eventually," he says.

Secondly, business leaders may have taken a cautious approach to their expectations for performance. "People may have set realistically low benchmarks within their own business and therefore think they can achieve their own targets, which is not necessarily a massive business success, but it is their own targets as opposed to the overall market being hugely positive," he suggests.

For Martin, the answer probably lies in the disparity between operators' own experience of running their business, and the general buzz of political and economic uncertainty generated by the Brexit process, often amplified by the media. "People are finding that they are still trading, they are still in business, and they haven't gone to hell in a handcart," he says. "Not everyone feels that, but most are comfortable in their own business and in themselves as good operators. But you are also getting this background noise all the time that it is tough out there. I suppose in one sense that is not a bad place to be, rather than being over-confident."

Differing levels of optimism

Of course, the overall figures for how optimistic business leaders feel hide considerable variations between sub-sectors of the market. Whether you look at the next six months, or the next 12, it is foodservice companies (contract caterers) whose spectacles have the rosiest tint.

Chris Stern, founder of workplace catering consultants Stern Consultancy sees two chief reasons for that. Firstly, a fundamental shift in eating habits among the UK public means that they are cooking at home less and are far happier to eat at work or on the move. At the same time, recent years have seen caterers compelled to get far better at drawing in customers who might otherwise venture onto the high street.

"Clients have said they want to spend less on catering and removed subsidies, which funnily has actually forced caterers to do a better job and made it more attractive to people," he explains, noting that many now follow high street trends for street food, local sourcing, and seasonality, as well as continuing to offer traditional favourites. At the same time, and perhaps crucially, caterers haven't had to deal with sharp rises in some structural costs – namely rents and business rates – that have given so many of their restaurateur counterparts a headache.

When it comes to hotels, both chain and independent hotel business leaders report similar levels of performance over the past six months, and yet the proportion of independents who describe themselves as optimistic or very optimistic about their business prospects over the next six months is 17 percentage points higher than it is for chains. Gold suggests that this is simply to do with the different expectations chain and independent business leaders place on themselves. "Chain leaders may well have more internal expectation," he says. "You are going to judge your feeling of confidence on your ability to hit those targets. Whereas if you are an independent hotel, perhaps you might have owned the property for a while and therefore bank debt might be more manageable and you might be more concerned about personal earnings. I don't think independents are in generally outperforming chains. I think they are all subject to similar influences but that people are judging against expectation."

That certainly looks likely to apply to the pub and bar sector where optimism is higher than might have been expected. Some 72% of business leaders declared themselves fairly or very optimistic about their business prospects over the next 12 months, despite the well-documented struggles in the sector over recent years, with consumers drinking less alcohol and community pubs closing rapidly.

CGA's Director of Food & Retail Karl Chessell adds: "Pubs and bars had a really strong Summer last year with the sunny weather and a strong showing by England in the men's World Cup. This performance held up over Christmas as well, so pubs and bars have been accustomed to more positive like-for-likes. Whilst consumers may be moderating their drinking, we are seeing premiumisation across all drinks categories. We have also had a steady easing of supply in the drink led market as pubs have closed in net terms consistently over many years."

When it comes to restaurants – both independent and chain – optimism levels are relatively subdued and it's tempting to attribute this to the recent spate of CVAs among chain restaurants. The causes of some of those CVAs undoubtedly plays into restaurateurs' sense of how they see the coming months – rising business rates, labour costs, food inflation, rents and other factors all play their part and are set against a backdrop of wider political uncertainty.

But it would probably be wrong to assume that the issues add up to the prospect of any significant contraction in the restaurant market, at least for the time being. While the survey showed that there was a 2.8% reduction in the number of licensed restaurants in the year to March 2019 and there is oversupply, somewhere around 80% of net closures have happened in the independent sector and these "mama and papa" operations are a new group of operators coming in to fill their place.

"We are seeing a flat market in terms of demand. People are still going out and spending but value experiences over buying goods. Luckily, we are not seeing demand fall away as it has in other sectors such as retail and automotive," Chessell explains. "The issue is the level and quality of competition is as fiercely high as it has ever been. This is great for consumers but means market share is being battled out amongst operators—that's the real problem."

Consumer confidence – should business leaders be so worried?

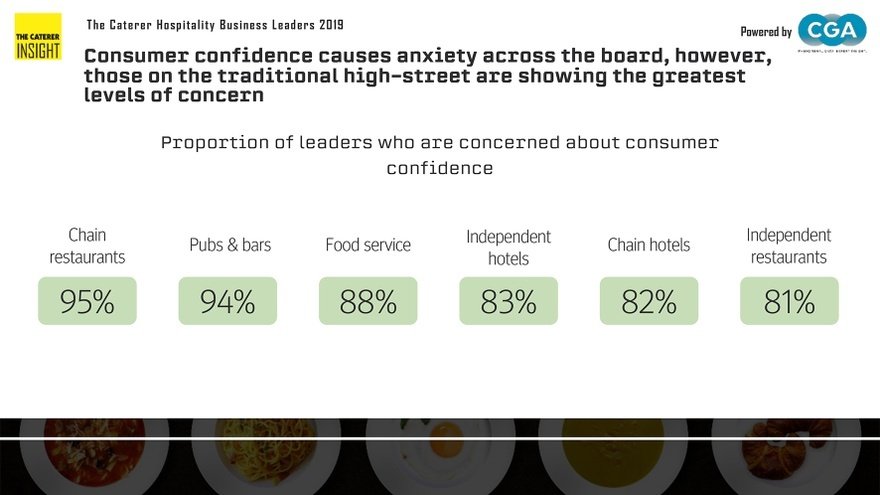

On average, 88% of business leaders are concerned about consumer confidence. In chain restaurants, that hits 95% and while independent restaurants reported the lowest level of concern, the figure still stood at 81%.

Should they be so worried? Gold questions why concern about consumer confidence should be so high when business optimism is also comparatively high but sees the uncertainty around Brexit as one of the main causes. "Whatever one thinks about Brexit, people want it done or not done," he says. "There seems to be acceptance even among a lot of remainers that it needs to happen and soon."

Professor David Russell, chairman of hospitality consultancy The Russell Partnership is of a similar view. "The lack of confidence is worryingly high," he says. But he urges operators not to panic. "I am lucky enough to be non-executive director on a number of food-based boards and every single conversation in the last three months has been about caution, investing in people, and not panicking in terms of confidence. We have all been here before and we know how to manage a challenging marketplace. But it does mean everyone is uncomfortable about general economic trading conditions. It has a huge impact on the operator and consumers feel it too."

Chris Stern, on the other hand, is somewhat less concerned. "Operators are right to be worried about consumer confidence, but what does it really mean?" he asks. "What is it really going to do to a foodservice business? The only real problem is if a client they cater to shrinks or disappears. The European Medicines Agency went to Amsterdam so BaxterStorey lost a piece of business there. You can understand caterers who caterer to organisations like that being worried, but consumer confidence is less of an issue."

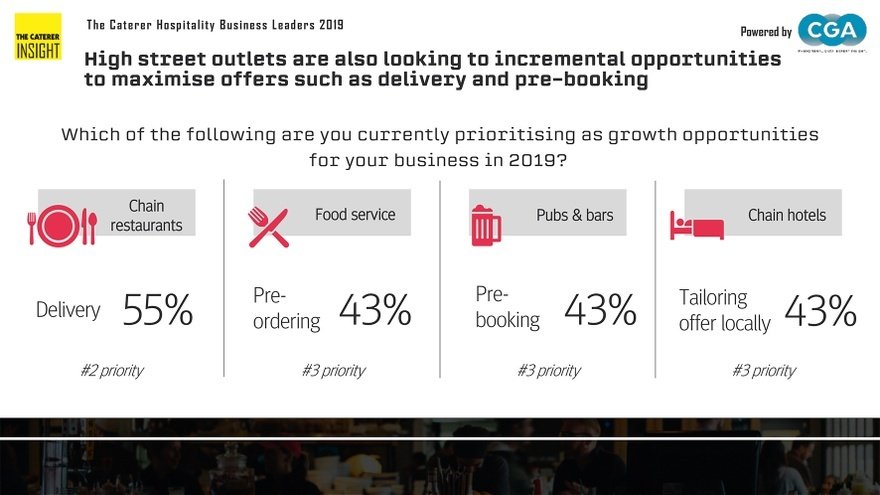

Delivery: an uneasy relationship

High among chain restaurants' priorities when it comes to developing new growth opportunities this year is delivery. But the strategy is not without its dangers, as Peter Martin explains. "Delivery is here to stay and people are finding it is providing incremental sales. But they are also concerned about a lack of control of your brand image through that, and the potential for reputational damage."

Chain restaurants will have to ask themselves whether they can find the margin they want in the delivery market and how they keep control of their offering, since only the very biggest companies have the resources to run their own delivery network. "At the end of the day, if the food is bad then the restaurant gets blamed and not Deliveroo or Uber Eats," says Martin. "The other problem is when businesses start working with delivery companies and then the delivery companies start producing their own brands in dark kitchens – thanks for that guys. So the relationship is not a bad one. But it is not always a happy one."

Is catering's high barrier to entry falling?

Part of the reason for the high levels of confidence within the foodservice sector could be attributed to positivity among smaller caterers who see lower barriers of entry when it comes to winning major contracts, according to Julian Fris, managing director of consultancy firm Neller Davies.

"We are seeing a flattening out of the risk profile which is changing the way catering business leaders view the market," he says. "The SMEs see a real opportunity. I think there is a realisation among clients that they want to move on and give others a chance, while larger companies need to reinvent themselves if they want to stay in the sector."

He cites the recent entry into the market of Houston & Hawkes, among others. "The people within clients who are making the decisions are changing," he says. "It used to be very difficult for the smaller operators to take on the level of risk the big guys could but post Carillion and Interserve, there is a rethink in government about how they want to buy services. Contracts managers are also retiring and moving on and a new breed of client is emerging and they are a different animal altogether."

Continue reading

You need to be a premium member to view this. Subscribe from just 99p per week.

Already subscribed? Log In