VAT – are you weathering the storm?

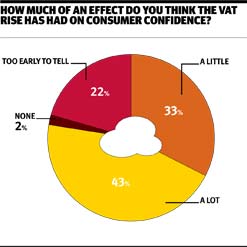

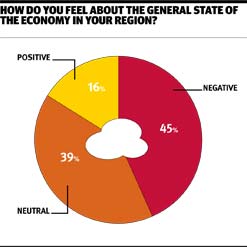

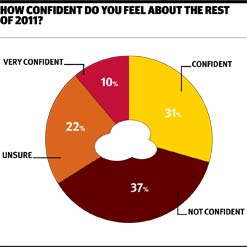

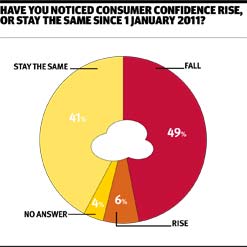

The much-feared rise in VAT to 20% finally arrived at the start of January 2011. But how have hospitality businesses throughout the UK fared? Neil Gerrard reveals the results of Caterer's survey on the issue

January is a miserable month at the best of times, but the prospect of a VAT hike just after December's freezing weather had the potential to leave more than a few hoteliers, restaurateurs, publicans and caterers staring glumly into their porridge of a morning.

So six weeks after Chancellor George Osborne's measure was introduced, Caterer teamed up with Caterersearch.com to launch an online survey gauging how the industry has fared as well as quizzing a variety of operators throughout the country on their individual experiences.

Sadly there appears to be little prospect of the Government making any such concession any time soon. So far there has been no indication as to when it plans to bring VAT down from 20% for any industry and the prospect of a deeper reduction for hospitality businesses appears remote.

And Alex Reilley, mananging director of casual dining and bar chain Loungers, said: "VAT is a cute tax to increase because you are just paying it all the time. But very little of what we serve is over £10 so 5p or 10p here or there is not too bad in the grand scheme of things.

"I think it is less of a concern than what is going to happen with food prices. We have seen cooking oil increase dramatically in price in the last 12 months. The food markets are very volatile."

suggestions for the government

Caterer asked respondents: If you could suggest one measure the Government could take to improve the prospects of your business, what would it be?

"Do not increase the minimum wage."

Restaurant, Midlands

"Reduce VAT to 15%. There are several other measures I would like them to take but primarily VAT at 20% could be enough to sink my 40-year-old business."

Hotel/B&B, Scotland

"Reduce VAT for the restaurant trade to create employment."

Restaurant, South West

"Resign?"

Hotel/B&B, North East

"Parity with Europe on VAT on accommodation and food. To assist continental visitors and the home market, do not charge VAT on top of excise duty. Withdraw the percentage increase on employers' NI contributions."

Hotel/B&B, Scotland

"Lower the minimum drinking age"

Pub/bar, South East

"The fuel prices are going to be the killer for everybody, except the Government. They should cut the duty on it to help boost the economy."

Pub/bar, South West

Cheaper cuts and frequent shops: The effect VAT has had on purchasing

Ron Hickey, sales director - catering, Booker We have noticed customers are buying more frequently, which means little-and-often purchases. There is an element of switching from brands to high quality own-brand and some evidence that customers are rejigging their menus - for example, using sirloin steak instead of fillet. We have also noticed that our customers are using more of the cheaper cuts of meat such as belly pork. Chefs are being more creative in the use of these cuts as they do not compromise on quality of their menus and are tasty dishes.

Caterers need to keep an eye on costs to ensure they are getting the best value. And as time is precious, more customers are making use of delivery services.

The most important piece of advice I can give is to keep an eye on price. Shop for best value.

How have you been coping with the VAT rise?

Patrick Harbour, Co-founder, Harbour and Jones (contract caterer) Our market sector is incredibly competitive and we are always reviewing how we can offer exceptional quality and consistency for a value price. The VAT increase clearly has made this more challenging but the same principle applies.

Mark Godfrey, MD of Harbour Hotels Collection (group of five hotels in Dorset, Devon and Sidmouth) We have increased prices in certain parts of the business - for instance, we felt a price increase in some of our food and beverage items and spa treatments was appropriate. We have actually seen good growth on the same period last year and this is down to careful planning, a robust marketing strategy and a flexible attitude to pricing.

Alastair Scoular, the Steam Packet Inn, Isle of Whitorn, Scotland (5-bedroom hotel and pub) The drinks prices have produced the usual bout of moaning from the regular drinkers even though it is acknowledged that I have had no alternative. We will only see the real impact of price increases when the tourist season opens up but I think that, like last year, the customer will be very value-orientated.

Craig Mayes, operations director, Charles Wells (250 pubs across 17 counties in England) From what we've heard, the effect of the VAT rise has passed under the radar of customers. They're obviously talking about prices rising, but don't seem to associate that the increase in the price of a pint of beer is linked, through VAT, with the increase in price of, for example, a plasma TV. Early indications from the sales performances recorded since the New Year show strong volume performance against both budget and last year but this is across a varied estate.

Kevin McCarthy, director, the Castle hotel, Taunton, Somerset In anticipation of the increase in VAT we adjusted our all our wine and drinks prices in December, ahead of the rise, and so from a customer point of view it was lost among the Christmas revelry and the snow. Room rates are largely quoted excluding VAT since the majority of our demand is corporate and for them VAT is recoverable. For the leisure market we are constantly flexing our rates so VAT rate changes, although implemented, will not be apparent to the customer.

Asher Svirsky, MD/owner of Basilico (London pizza delivery firm) Business has not been affected per se, as the VAT increase was only part of the total price increase that we've had to pass onto the customer due to higher food, energy and operational costs. It may even be advantageous to the delivery market as consumers will spend less in restaurants and choose to opt for home delivery.

Andrew Brown, chef-proprietor, Brown's Café and Grill, Darlington, Co Durham January has been a good month for us and the final week was, in terms of takings, our second best since we started trading this time last year. However, there has been a noticeable decline in people's generosity as far as tipping is concerned, although this might just be seasonal. I am optimistic that it will be business as usual in the coming months and that the increase will not significantly change people's eating-out habits.

<span class=""noindex"">E-mail your comments to Neil Gerrard here.

Caterersearch.com jobs

Looking for a new job? Find your next job here with Caterersearch.com jobs

|