Where are the opportunities for operators in 2019?

There's plenty of chances for investment and growth over the coming year for shrewd hospitality operators who can tap into the trends. The team at Christie & Co tells The Caterer where the profits lie

Despite the well-documented struggles of restaurant chains in 2018, the year for many hospitality operators was surprisingly upbeat.

Though there is undoubtedly renewed uncertainty following last week's Brexit vote, the hospitality sector appears robust, according to the Christie & Co Business Outlook 2019: Navigate, Innovate, Accelerate.

The report, which reflects on the themes, activity and challenges of the previous year and forecasts what 2019 might bring, suggests that independent restaurants could thrive this year, while revenue per available room (revpar) in hotels is set to increase, albeit at a slower rate than last year. The prediction for pubs is also largely positive, with those that have added letting rooms being particularly well-placed, despite rising cost pressures.

Christie & Co managing director Chris Day said: "The highly publicised struggles of big chain brands in the casual dining space have cast doubt in the market; however, the issues really stem from oversupply rather than a lack of customer demand. Operators who distinguish themselves from the crowd and present a unique offering are thriving, along with those who continue to reinvest and innovate. This is true across all sectors, where being able to adapt, adopt new trends and introduce relevant technology to improve services and cost-effectiveness will see any business prosper compared to those who have failed to prepare for the future."

He added that though there was some slowdown in the markets in which Christie & Co operated at the end of 2018 due to Brexit, this is likely to be short-lived, with the hope that clarity about the outcome will lead to a boost in market confidence.

Day said: "Looking ahead to 2019, the market will continue to realign itself along with consumer demand, and in every sector the quality businesses moving forward with future developments are set to continue to thrive. New concepts are coming to market all the time and, with technology evolving, the time has never been better to capitalise on new opportunities in business.

"There continues to be an abundance of capital available, despite some caution from the larger banks, and there is still plenty of opportunity for funding through smaller banks, Funding Circle, angel investors and private equity." Day believed that with so much capital trying to find a home, shrewd, independent operators should be encouraged, particularly as venture capital is increasingly looking to support hospitality start-ups.

Hotels

A number of large portfolio deals in 2018 overturned Christie & Co's predictions for the amount of hotel transaction achieved during the year. At the beginning of the year, the company said that it expected there to be a slight decline in total sales during 2018 following an 18% year-on-year increase to £5.3b during 2017. However, as the result of the likes of the £858m acquisition of the Principal hotel group by French group Covivio, the number of hotel transactions increased in value year-on-year to £6.5b.

Barrie Williams, managing director of hospitality at Christie & Co, said that predictions can be thrown off-course by unexpected major deals.

Key hotel deals for Christie & Co in 2018 included the sale of the 135-bedroom Eynsham Hall near Woodstock, Oxfordshire, off an asking price of £8.25m by Cathedral Hotels to Ennismore, owner of the Hoxton brand and Gleneagles, and a portfolio of five Marriott properties to Britannia Hotels.

Williams said one of the largest deals that could go ahead this year is that of the 17-strong Grange Hotels collection, privately owned by three brothers, Harpal, Raj and Tony Matharu, with a price tag of around £1b.

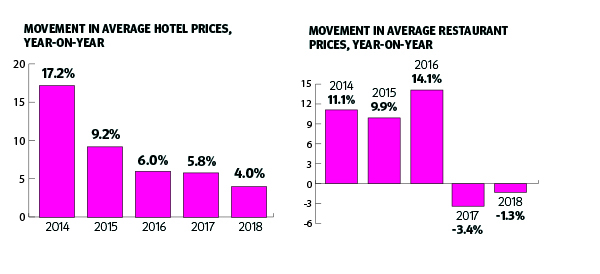

The price of hotel assets has consistently increased since 2014, albeit at a slower rate year-on-year since then. While prices rose by 17.2% in 2014, that increase had slowed to 4% last year and Williams expects that the rise in hotel prices will fall again this year.

"While the rate of increase is likely to be slower, we still expect prices to rise as there is a lot of interest in assets by a number of different parties, both institutional and family owned, and from a number of different locations, including India, Israel, Singapore and Hong Kong," explained Williams.

The biggest concern for hoteliers during 2019, according to Christie & Co, will be the ongoing increase in costs, including food, rates and staffing, following a rise of about 20% over the past two years. As a result, a revpar increase of less than 1% is predicted, down from 1.5% in 2018, with earnings before interest, tax, depreciation and amortisation largely remaining flat.

In terms of new hotel supply, there are likely to be more than 10,500 new rooms across 85 hotels opening in London and an extra 25,500 new rooms across 295 hotels launching in the regions from July 2018 to the end of 2019. The key cities for growth outside London include Manchester, Liverpool, Edinburgh and Belfast.

Williams did not expect that the ongoing expansion of the hotel sector will lead to saturation of the market. "Every year there are more and more openings, and every year there is always more demand to meet the growth, which over the past two years has come about as the result of an increase in tourism and the weak pound.

"No matter what the standard of the accommodation is - whether it is budget or five-star, hostel or aparthotel - it all appears to be working, while at the same time there is a drop off of hotels at the lower end of the market, where there has been no investment."

Restaurants

Independent and smaller operators who can distinguish themselves from the crowd are likely to be the winners of 2019, as larger chains continue to feel pain on the high street.

Further casualties of the much-publicised casual dining crunch are "inevitable" in the next 12 months, reported Christie & Co's Business Outlook 2019.

Head of restaurants Simon Chaplin said: "Invariably history tells us that, of those people who have gone through a company voluntary arrangement [CVA], more often than not they'll end up in administration. It may stem the flow for a year, maybe two or three, but invariably the problems are so deep that it's just putting off the inevitable. I would expect one or two of them to go into administration and I think there are two or three other groups out there who are teetering on the edge."

The closures seen in 2018 have seen landlords reduce rents or offer more favourable terms, providing opportunities for smaller dynamic operators, who Chaplin said can be "cautiously optimistic" about the year ahead. He explained: "New operators are seeing a great opportunity because sites are being made available where they would not previously have had a look in. Landlords are saying, I'm not going to get £70 per square foot, I'll bring it down to £40, and at £40 a lot of these smaller operators can afford to take them."

The priority of consumers towards experience and value is expected to continue through the next 12 months, as is the growth in the market for vegan, vegetarian and allergen-free dishes. This will present opportunities for smaller operators who can be flexible with their offering. Chaplin also predicted that the grab-and-go and fast-casual markets will continue to see an uptick, while giving operators greater control over costs as uncertain times approach.

He said: "There are opportunities out there and you don't need to appear on My Million Pound Menu to get the money behind you. Crowdfunding is still a good way to raise money and there's lots of private capital out there looking to invest - it's still a cheap time to borrow money. There are empty properties out there and if you can get a fully fitted restaurant for a £40,000-£50,000 premium, when it would have cost you £250,000 minimum to fit out, that's such a saving. It gives you an opportunity to get a head start, as long as the rent is right.

Landlords are having to cut their rents accordingly or offer extremely good deals with three-year rent reviews or a contribution towards fit-out. If you've got the right offer and something different and you're focused, then I think those entrepreneurial restaurateurs and operators should be optimistic."

The situation on the high street also presented opportunities for diverse operators who can take advantage of larger multi-use spaces. With retail having taken a hit, Chaplin predicted that large city centre sites, such as shopping centres, would become home to street-food concepts such as Market Halls, which opened sites in London's Victoria and Fulham in 2018, while others will look to combine leisure with accommodation and office space, presenting more opportunities for savvy operators.

Brexit poses a number of risks to the industry, most notably a decline in EU staff. Leading software platform Fourth Analytics reported that EU nationals composed 40% of the UK's hospitality workforce as of June 2018, and operators are being forced to consider alternative staffing or streamlining opportunities.

Should food import costs rise depending on the Brexit outcome, the report suggested that better menu creation and sourcing more ingredients from the UK or outside the EU will keep costs to a minimum.

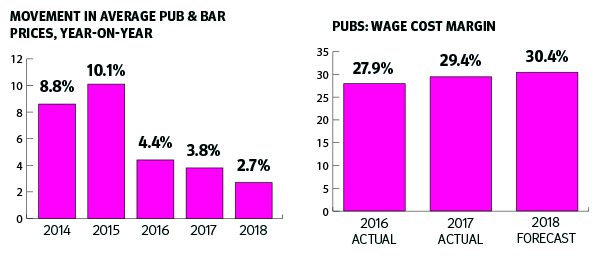

Pubs

Christie & Co said 2018 may have been a turning point for British pubs, following almost a decade of turmoil, as trade received a boost helped by a glorious summer and the World Cup.

The Business Outlook 2019 reported that although pub numbers have fallen by 28% since 1989, turnover was in line with 2008 levels, as pubs generated new business and absorbed trade from operators who have called time.

Noel Moffitt, senior director of corporate pubs and restaurants, explained: "We see the industry turning. It's gone through a long period of turmoil over the last eight, nine years, and what we're now seeing is that the businesses are establishing themselves. Pubs are now doing well again, both in terms of beer sales and food. The one issue that is hitting everybody is cost pressures - National Living Wage, pensions, apprentice levy - that's in the background, but in the midst of that trade is still up and pubs have had a good Christmas."

A particular area of growth since 2001 has been large pubs. Moffitt added: "Large pubs are working well. They don't take an awful lot more management to run, but the revenues can be two, three, four times more than smaller pubs. You've got the likes of Marston's, Greene King and Mitchells & Butlers, as well as some of the regional operators who are building new pubs. What they tend to find is that if you're building a new pub, it's fit for purpose and far more efficient to run."

Turnover has also been aided by the devaluation of the pound following the Brexit referendum, which has boosted inbound tourism as well as the popularity of staycations. Pubs with letting rooms have been able to take particular advantage of this, competing successfully with both budget accommodation providers and the boutique market.

Despite positive headlines, Christie & Co predicted 1,000 pubs will need to close in the next two years to reach an equilibrium of 47,000 sites. Moffitt said: "There will always be closures, because there's a point where a pub becomes uneconomical because it's not used by locals.

"We believe there is the support to keep 47,000 pubs viable and as well as closures we're seeing a lot of micro-pubs, tap rooms and pop-up bars opening."

Cost pressures, particularly those related to staffing, have seen overheads reach an average 52.5% of net revenue - up 3% in just two years. Wage cost margins are forecast to have reached 30.4% in 2018 - up from 27.9% in 2016, driven by the National Living Wage rise, apprentice levy and pension auto-enrolment.

With limited opportunity to pass costs on to the consumer, margins are expected to erode further through to 2020. But rents present a more cheerful outlook, with CVAs pushing landlords towards more sustainable rates and reductions of up to 30% becoming commonplace.

Mergers and acquisitions were sporadic in 2018, although interest from private equity remains strong. The year did see stalwarts, including Fullers, Marston's and Punch Taverns, acquire small portfolios in package deals. Moffitt expected to see further mergers and acquisitions into 2019. He added: "There are transactions going on and discussions being had. You've got investors looking at the smaller groups because the larger opportunities aren't always available. It's been very positive and there's definitely room for growth within the sector."