Bearing the brunt of higher staff costs: how are business leaders keeping up quality service?

The recent rise in staffing costs hit hospitality’s most important asset: that a business cannot exist without great people. So how have operators alleviated that cost pressure? The Caterer’s Business Leaders Survey reveals their tactics

Costs continue to be a major challenge for the hospitality industry, particularly around labour, resulting in major job losses across the sector as companies look to decrease their outgoings.

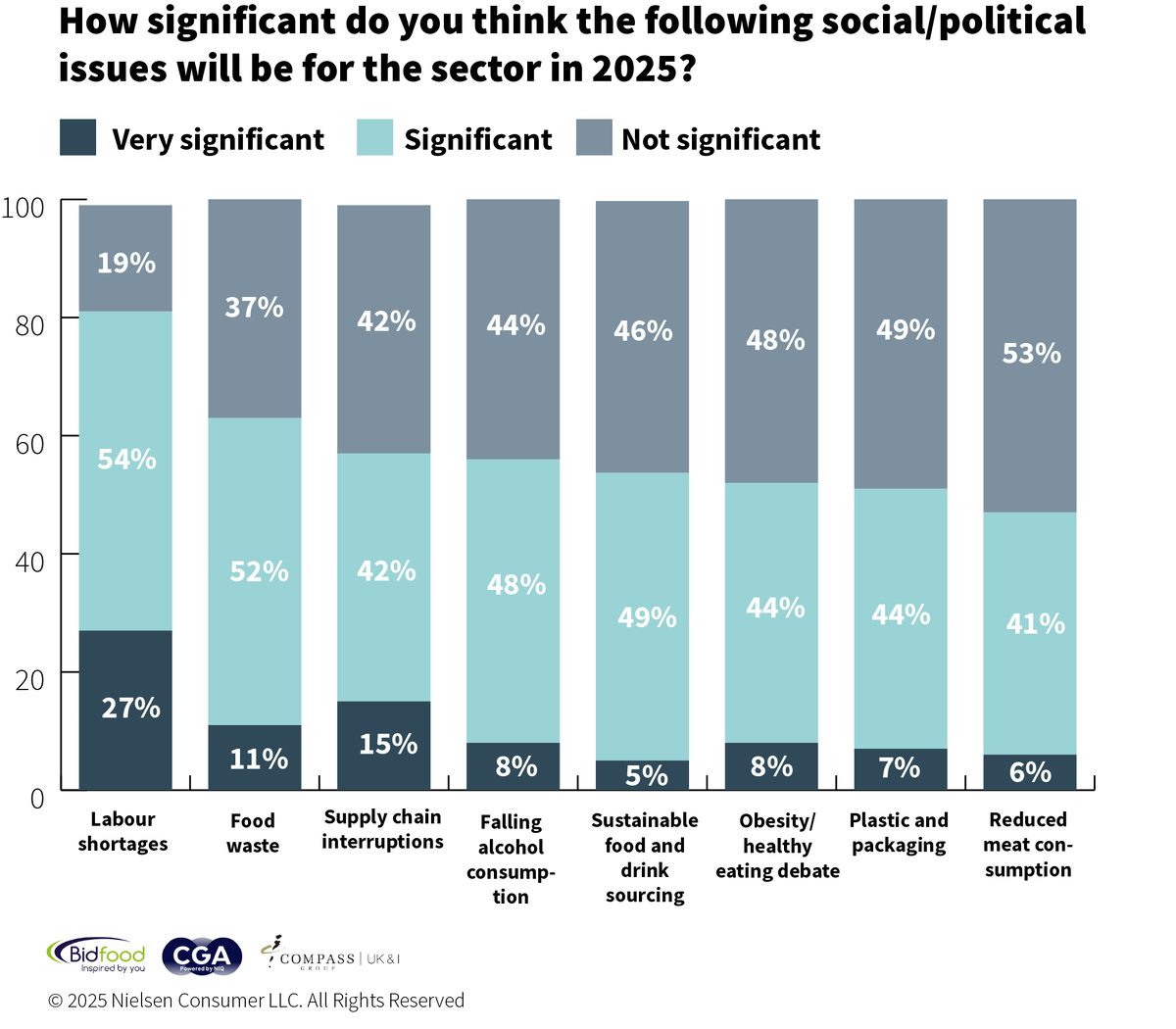

The Hospitality Business Leaders Survey 2025, produced by The Caterer and CGA by NIQ, sponsored by Bidfood and Compass Group, has found serious changes in employee costs over the past year, with 83% of businesses surveyed having been hit with higher front of house staff costs and 81% experiencing increased back of house employee costs.

The effects of changes to National Insurance Contributions (NIC) have already had a devastating effect, with the Office for National Statistics (ONS) figures revealing that the hospitality sector has lost 69,000 jobs as a result of the tax changes. And the forecast is not good, with UKHospitality calculating that 200,000 jobs could be lost if the government does not reverse those changes.

Reuben Pullan, senior insight consultant at CGA by NIQ, says hospitality leaders’ confidence has taken a hit in the past couple of years: “There’s widespread pessimism as we enter the second half of a challenging 2025,” he says. “This is hardly surprising given the persistent inflationary pressures on operating costs – especially around labour.

“Hotels, with their complex operations around accommodation and leisure, in addition to a food and beverage offer, are even more exposed to the increasing expense of staff. Within this sector, 6% more operators are seeing their wage bills rising.”

Richard Ferrier, chief executive of Heartwood Collection, adds: “Labour costs have increased materially, driven by the rise in the National Living Wage and changes to NICs. As a result, we’ve seen around a 10% annualised increase in labour costs since 1 April.”

Harneet Baweja, founder of Harneet Baweja Company, which operates the Gunpowder and Empire Empire restaurants, says the situation is “quite dire in London”. He says the result of the cost increases is the closure of many restaurants across the capital which, in turn, has led to him being offered the sort of quality properties that would not have been available to him previously.

He is also concerned about the labour situation and the knock-on effect on London’s competitiveness as many skilled workers return home, which has strengthened hospitality offerings in destinations such as Prague, Warsaw and Lisbon, where he operates a restaurant. “Portugal’s costs have gone up, but it’s not as bad in Continental Europe as the UK. These cities are all catching up with London.”

Staff costs versus room profit

Hotels have been hit somewhat harder, according to the survey, which found front of house costs increasing for 89% of hotel respondents compared with 83% across the whole sample. For back of house this was 86% versus 81%.

Ferrier says the rise in staff costs has coincided with room rates having, at best, stabilised and, at worst, begun to soften. “A key challenge is the knock-on effect of National Living Wage increases on wider pay structures. As the base rate rises, employees at higher levels expect their pay to adjust accordingly to maintain parity and progression. Unless the government revisits its policy of linking minimum wage increases to median earnings, this will remain an ongoing structural challenge for operators,” he says.

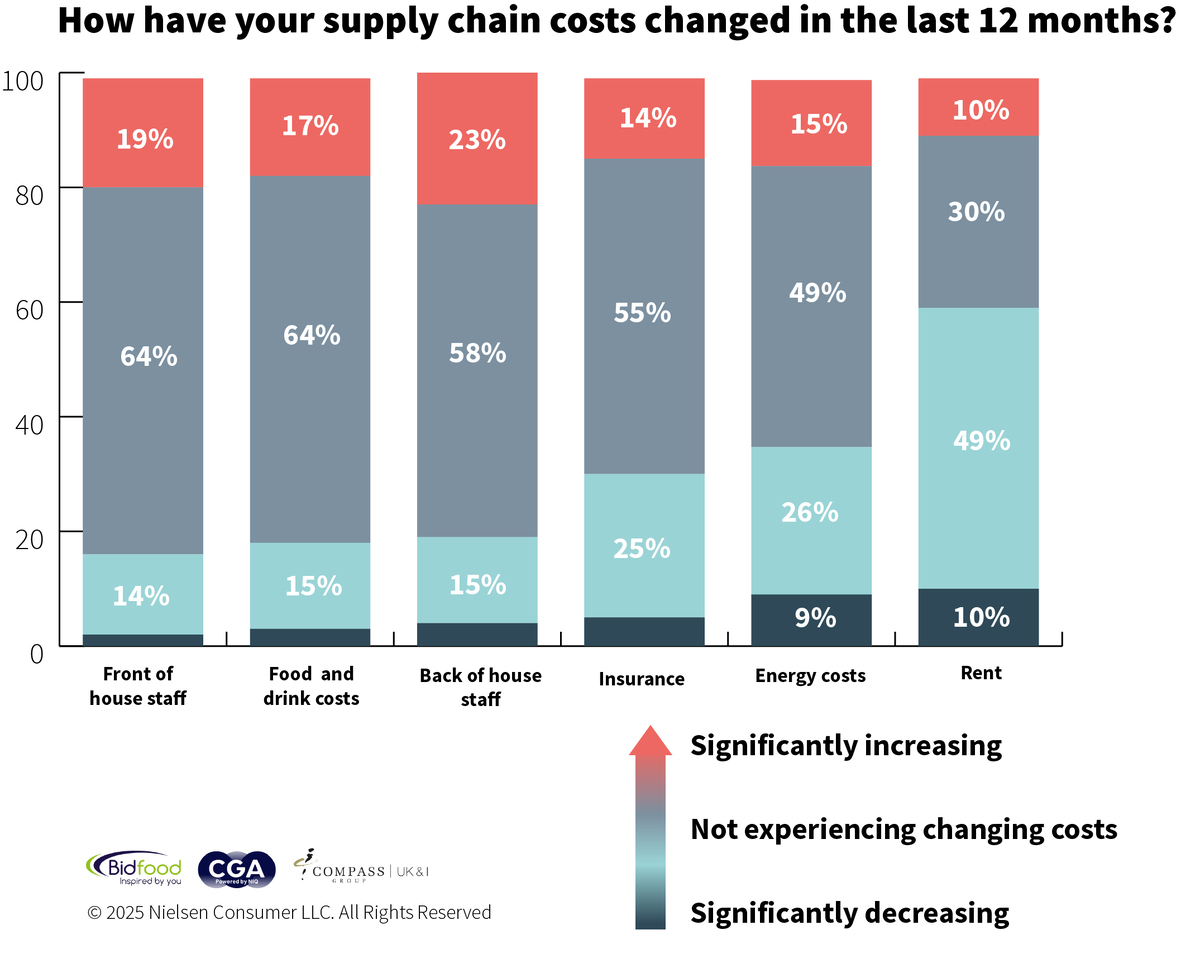

It’s not just employee costs that have been on the increase: the survey found 81% of companies have experienced higher food and drink costs over the past year, 69% have had higher insurance costs and 64% have seen higher energy costs. The only category with less pressure on it has been rent, which has shown an increase for 40% of respondents.

Ferrier says: “We’ve seen a significant 47% increase in deadweight beef prices over the past 12 months. Despite taking reasonable price increases, we’ve had to accept lower margins on all steaks. Energy costs, while mercifully reduced from recent peaks, remain stubbornly high and are still running approximately £1m above where they were three years ago. On a positive note, drink prices have broadly stabilised, but the introduction of a new duty regime on wine has forced either price increases or reductions in alcohol by volume to manage costs.”

Staff become the target of cutbacks

Against this backdrop of price increases it is inevitable that cost cutting is on the agenda of many companies. The workforce is the primary target, and this is more pronounced in the hotel sector. The survey found that reducing staff hours or fewer staff per shift was on the agenda for 58% of respondents (60% of hotels), freezing recruitment was the plan for 46% (52% of hotels), and cutting the number of staff employed was the harsh decision made by 44% (46% of hotels).

Baweja says: “We can’t cut any more costs. We’ve already cut all we can and we can’t compromise on quality.” What he has done is follow the 24% of companies that have reduced their opening hours. His restaurants now close on Mondays (except Gunpowder in Spitalfields), as a result of fewer people travelling into offices on that day.

Ferrier is also reluctant to bring out the scalpel. “We have always believed that driving guest volume is the most effective way to improve labour ratios, rather than reducing opening hours or restricting service.”

Encouragingly, he adds that the company has opened six pubs with rooms over the past 15 months and these sites are steadily building towards maturity, currently achieving more than 70% occupancy at highly positive room rates. As rooms are less labour-intensive compared to traditional food and beverage operations, Ferrier says Heartwood is already seeing a positive impact on overall labour efficiency as these sites mature. To sustain growth in this high-cost environment, Pullan says all businesses are going to need to stay right on top of consumer trends and adapt nimbly to new opportunities.

“With bills running so high, they will have to be resolutely focused on delivering full value for money and high-quality experiences,” he adds. “Finding efficiencies and optimising productivity – including through the smart use of technology – is important too. If businesses can achieve all this, we can be optimistic that the confidence of consumers and leaders alike will pick up in the months ahead.

Investment in knowledge

The survey also found that 14% of companies plan to reduce their investment in training, but this is not the route being taken by Simon Emeny, chief executive of brewer Fuller’s. He says: “We have always talked about the fact that it is our people who make the difference, which is why we have invested heavily in people development over recent years. I think this is going to enable us to tackle these issues in a slightly different way to our competitors.”

He says the company is already seeing the benefits of committing to developing leadership skills, which should help Fuller’s tackle any future issues. “By investing in our leaders at site level, we can give them the skills to manage their teams. This will be with an eye on labour costs, but with tools that go beyond a blunt instrument that just cuts hours. We want them to think about the make-up of their teams, to play to the strengths of the individuals and find ways to ensure all team members deliver their full potential – which we know will help keep those labour costs down,” he says.

Tips for easing payroll pressure by Adam Denny, development chef, Bidfood

Get faster and leaner in the kitchen

One of the most effective ways to tackle high costs is improving kitchen efficiency. Reducing menu complexity allows teams to work leaner and faster, cutting prep time and labour hours. Or you can reduce the amount of stock keeping units, which results in simpler inventory management and less waste, as food waste eats into profit margins.

Cross-utilising ingredients across dishes minimises leftovers and streamlines prep, and standardising portion sizes and training teams in waste reduction can also make a big difference.

Swapping branded products for high-quality own-brand alternatives is another great way to maintain consistency while reducing procurement costs.

Engineer a more profitable menu

Menu engineering remains one of the most powerful tools to boost profitability. A well-structured, focused menu helps improve kitchen efficiency, reduces waste and enhances the dining experience. Analysing sales data is key in identifying best-selling, high-margin dishes to replace underperformers.

The way a menu looks also plays a role. Visual cues such as bold text, icons or colour accents can spotlight dishes and guide consumer choices. Enticing descriptions also increase appeal – ‘fresh rustic garlic sourdough’ sounds more premium than ‘garlic bread’ at no extra cost. Simple touches such as truffle oil in mushroom pasta can also boost perceived value. Allowing diners to customise dishes, such as build-your-own burgers, adds personalisation and lifts average spend with little extra labour.

The lipstick effect

The lipstick effect, where consumers still want to treat themselves to small luxuries, means you can offer affordable indulgences, such as mini desserts, premium coffees or eye-catching mocktails. These carry strong margins while providing value-driven, feel-good experiences. Upscaling a classic or offering bite-sized treats provides guests with an indulgence that fits tighter budgets.

Digital and staffing efficiencies

We’re living in a digital age and technology can ease labour pressures. Digital menu boards, QR code ordering and self-service kiosks reduce the demand on front of house, especially at peak times. Smaller venues can benefit from cloud-based electronic point of sale systems or loyalty apps that automate administration, track performance and boost retention without heavy reliance on promotions.

Outsourcing non-core tasks such as cleaning, payroll or stock audits can free up time and reduce overheads, and investing in staff training to upsell profitable items is another easy win. Caterers Campus is our free customer e-learning platform, made up of 30 modules, where teams can learn at their own pace from any device and receive a certificate after completing each module.

A great way to get the whole team on board is to incentivise with mini challenges and set daily goals to boost product knowledge, morale and bottom-line performance. A weekly winner with a small prize can spark a competitive edge among staff.

With the right strategies, businesses can tackle rising staffing costs and build long-term resilience, all while continuing to deliver memorable guest experiences.

Read the 2025 Business Leaders survey in full

More insight from the Business Leaders surveys:

How hospitality’s business leaders are tackling recruitment in 2024

Why business leaders are putting sustainability at the top of the agenda

Business Leaders Survey: Is it time for hospitality to bounce back?

Produced in association with

Photo: David Tadevosian/Shutterstock