Business leaders have cause for optimism as guests look to make visits memorable

Responders to the Hospitality Business Leaders Survey 2025 are seeing a cautious but definite rise in diner bookings, with guests looking to create experiences through thoughtful choices

Hospitality operators’ predictions that 2025 would see a decline in visit frequency seem to have been borne out, but an anticipated increase in average spend has means there could be good news on the horizon.

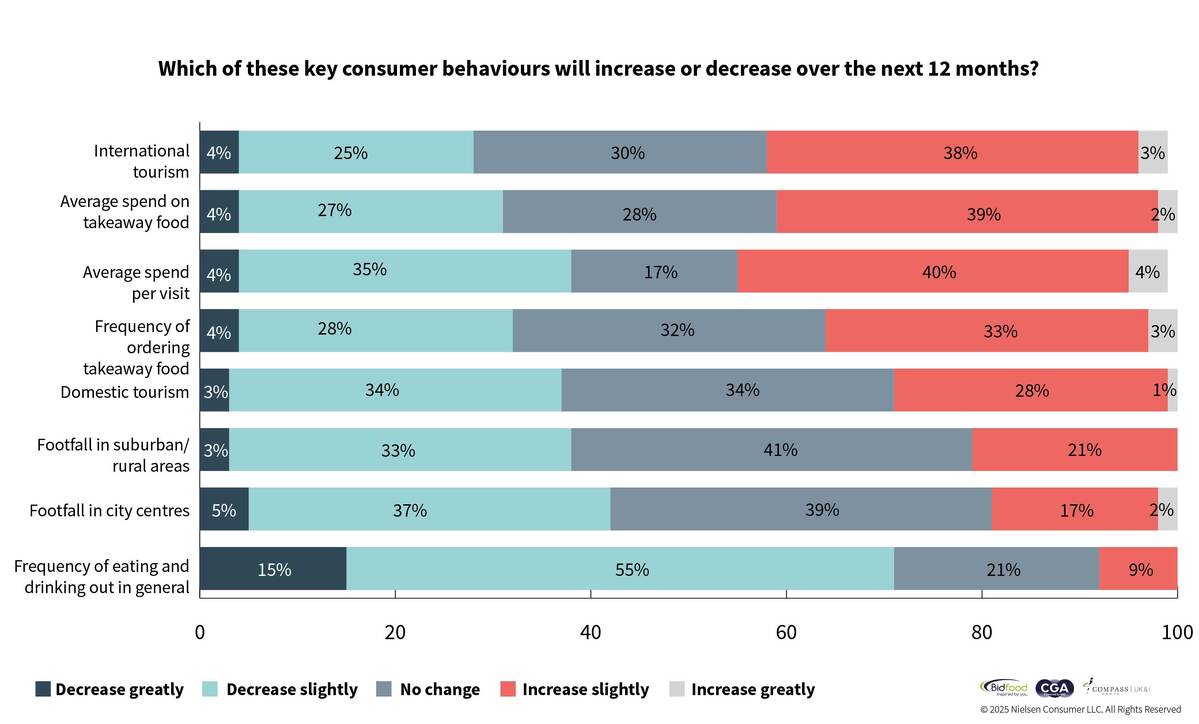

Business leaders responding to the Hospitality Business Leaders Survey 2025, produced by The Caterer and CGA by NIQ and sponsored by Bidfood and Compass Group, predicted a reduction in footfall in both urban and rural areas. The survey revealed that 71% expected the general frequency of eating out to decline, 42% expected city centre footfall to decrease and 38% anticipated footfall in suburban and rural areas to fall.

In response, casual dining group Honest Burgers, which has 40 venues, made promoting visit frequency its primary focus for 2025. It launched its loyalty programme Honest Insiders in June and has since signed up more than 91,500 members.

Jayson Perfect, chief operating officer at Butcombe Group, which operates pubs and inns across the south of England, says it is also using loyalty schemes to encourage return visitors as well as ensuring it has a variety of offers for guests, whether they’re looking for a casual meal or a memorable weekend away.

Perfect says: “Our latest data uncovered that Butcombe Boutique Inns have seen particularly strong performance, not only with consistent, regular visits from locals, but also in a rise in guests choosing our venues for special occasions such as birthday celebrations. This reflects a growing trend of customers seeking memorable, multi-purpose experiences.”

Rising restaurant costs

While operators had concerns about footfall, 44% expected average spend per visit to increase, while 17% anticipated no change.

Honest Burgers reported a 2% increase in average spend compared to 2024, despite choosing not to pass “significant inflationary pressures” on to customers through pricing.

“There is a broader industry trend where people are more selective about going out and needing compelling reasons to do so”

Emma Sherwood-Smith, chief commercial officer, says: “We are ultimately still seeing that customers are willing to spend when they go out, particularly when they feel they are getting a great quality experience. At Honest Burgers, we pride ourselves on our honest hospitality, an experience people are happy to pay for.

“Our top-selling burger for eat-in customers remains the original Honest Burger. and we have seen that customers are keen to spend a little more for new and different innovations and experiences. For example, our sides volumes are up 3% compared to last year, supported by our extended range. On the other hand, alcoholic drinks orders are slightly down, with a 1% decrease year-on-year, in line with the overall trend of moderation.”

Perfect adds: “We have in fact seen spend levels increase, particularly among loyal and repeat visitors. However, there is a broader industry trend where people are more selective about going out and needing compelling reasons to do so. When they do choose to go out, people are looking to celebrate and enjoy themselves fully, which aligns with our focus on delivering high-quality experiences and occasion-led visits. One example of this is consumers that have retired – although many have significant savings, they are more cautious with spending and need to feel confident they’ll have a great experience when they are out.”

Analysis by hospitality technology specialist Zonal found that 44% of consumers were prioritising fewer but better-quality experiences. Other changes in customer behaviour have also been seen, including booking times shifting earlier, to an average time of 6.12pm.

Defining value

When it comes to visit frequency, there could be good news on the horizon. Insight from CGA by NIQ suggests operators do have reasons to feel optimistic, with visit frequencies beginning to show signs of increasing, albeit alongside suggestions a plateauing of average spend could be ahead.

The insight group has suggested the easing of inflation, workers returning to offices and alcohol moderation are causing funds to be relocated to food, contributing to the shift.

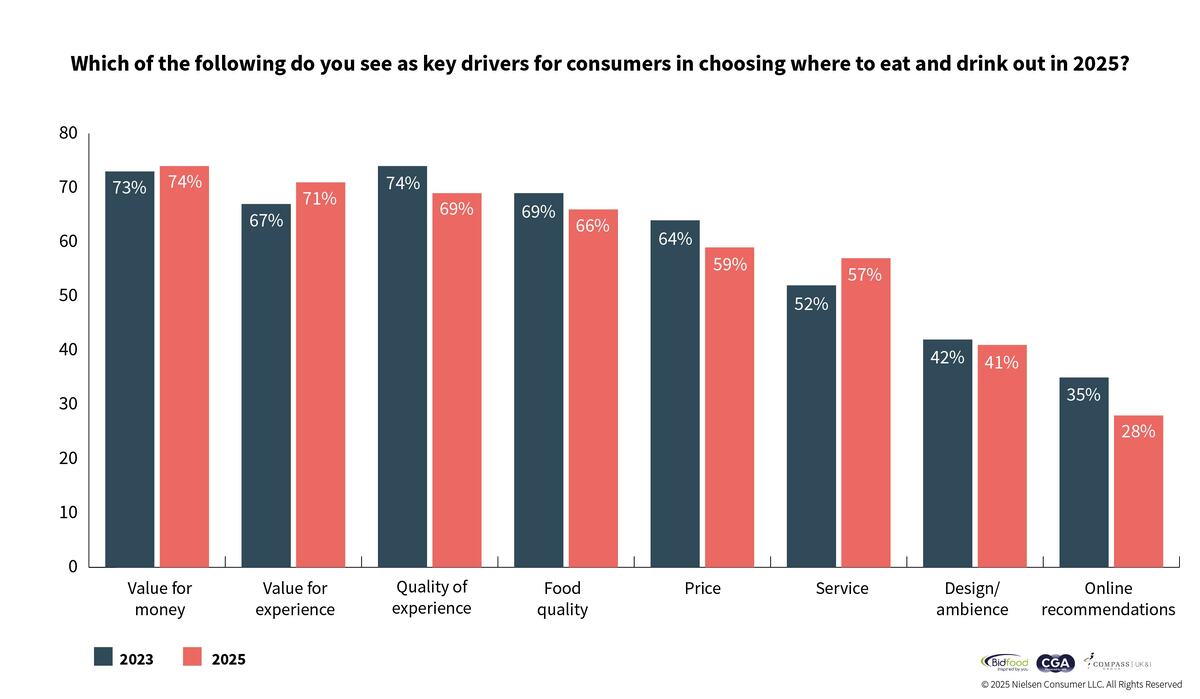

When choosing where to spend their money, operators responding to The Caterer’s survey expected the key drivers to remain largely consistent to those seen in 2023, although it was thought value for money would nudge ahead of quality of experience, which led the field two years ago. A majority of operators (74%) felt value for money would be a key driver, followed by value for experience (71%) and quality of experience (69%). In contrast only 28% believed online recommendations were a key driver for consumers.

What represents value may change from guest to guest, but many businesses have seen staying true to their core values, despite inflationary pressures, as crucial.

Sherwood-Smith says: “The key drivers for customers choosing to visit Honest Burgers remain the core values at the heart of the brand – experience, occasion, value and quality such as ‘always homemade’. Guests are looking for more than just a meal – they are looking for an authentic experience that feels worth their time and money.”

Hotels get active

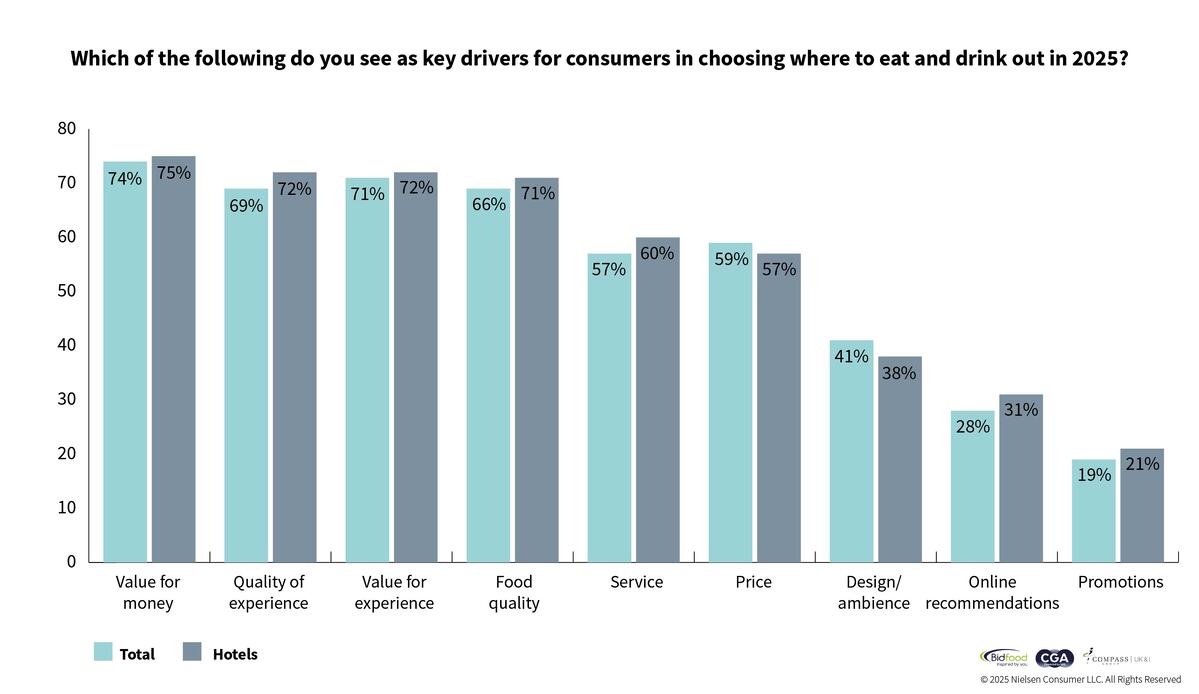

When hotelier responses to The Caterer’s survey were isolated, quality of experience was considered more important than value for experience.

Perfect says: “Experiences really are the key driver. Today’s consumer is looking for destinations that offer more than just food and drink – they want places that support active lifestyles and leisure and areas that offer plenty of things to do. Whether it’s hiking, cycling, running, exploring nearby towns and villages or simply relaxing and taking in the views, our pubs and inns are ideally located in the country to offer a rich and varied experience. This blend of activity and hospitality is increasingly influencing where people choose to visit and stay.”

When respondents were asked which formats are most expected to thrive in 2025, 44% thought premium casual dining would have a good year, followed by experience-led concepts (42%) and food market halls (31%). Notably, operators’ confidence in competitive socialising saw a dramatic fall compared to 2023, from 42% thinking it would have a successful 12 months to 10% in the most recent survey.

When asked which in-outlet experiential mechanics they were considering in 2025, 27% said tasting activities, 20% live music, 16% drinks tastings, 14% kitchen takeovers or pop-ups and 13% brand takeovers.

Honest Burgers paid close attention to emerging trends and launched its new smashed burger concept, Smash + Grab, at the end of 2024. Sherwood-Smith says: “We have continued to evolve our menu in response to emerging trends and customer preferences. Notably, over the past two or three years, we have seen a real boom in demand for smashed burgers, which now account for close to 30% of our total burger mix.

“Secondly, we feel that customers value choice and flexibility, which is why we include an option to customise our specials with choosing your own protein, helping drive 5% improvements year-on-year. Finally, expanding our soft drink range has helped to drive first drink purchases, showing a 4% increase year-on-year, suggesting customers increasingly value homemade and quality products.”

Butcombe also says that responding to emerging trends has boosted footfall.

Perfect adds: “Due to the recent increase in popularity around darts, we’ve seen success from adding interactive darts to some of our more wet-led pubs, where customers come in for a drink and to socialise with friends. This has not only met the increased demand for darts and competitive socialising, but also adds an extra dimension to customer experiences.”

Looking ahead

As 2025 draws to a close, operators will be hoping consumer confidence will build through to 2026.

Deloitte’s Q3 Consumer Tracker showed a slight uptick in overall consumer confidence, albeit by just 0.4%. This observation supports CGA by NIQ’s suggestion that frequency of visit is showing signs of an upward trajectory, something that has also been seen at Butcombe Inns.

Perfect says: “We are seeing strong festive bookings, with demand already surpassing last year. Interestingly, fewer customers are opting for the traditional festive menu and instead choosing from our standard menu. This is something we’ve witnessed for a few years and it has prompted us to adapt by incorporating festive specials into our core offering.

“Looking beyond 2025, premiumisation stands out across the board, with guests consistently choosing to trade up for higher-quality options. Similarly, the rapid rise of low- and no-alcohol drinks has blown up and small plates and sharing formats are becoming ever more popular, encouraging longer dwell times and boosting spend per head. We also expect health and wellbeing to continue to influence choices, shaping both menus and guest expectations.

“Our pubs are evolving into multifunctional community hubs and are being used for many more varied activities, including breakfast, brunch, working-from-the-pub bookings and event spaces. Weddings and parties are also on the rise, with guests seeking immersive experiences in beautiful settings with exceptional food and drink options, moving away from the traditional hotel event format.”

While there is clearly cause for optimism, operators remain cautious and are aware that the battle to attract customers will remain fierce into the New Year.

More insight from the Business Leaders surveys

Read the 2025 Business Leaders survey in full

Comparing value with cost: Business leaders offer a path to profit

Business leaders urged to jump in and get involved with AI

How hospitality’s business leaders are tackling recruitment in 2024

Why business leaders are putting sustainability at the top of the agenda

Business Leaders Survey: Is it time for hospitality to bounce back?

Produced in association with

Main photo: Milan Ilic Photographer/Shutterstock