Hospitality Business Leaders 2019: A picture of health

Veganism, sustainability and ‘no and low' alcoholic beverages are the trends tempting today's health-conscious consumers, and operators looking to provide something indulgent will have to think outside of the box

Consumers are eating and drinking more healthily, exploring new diets and cuisines, and demanding top experiences when they go out for a meal or a drink.

Those are among some of the big trends revealed by the Hospitality Business Leaders Report – new research by The Caterer that is powered by CGA's exclusive survey of more than 500 leaders across the restaurant, hotel, foodservice, and pub and bar sectors.

Keeping healthy

One of the key themes highlighted in the report was the impact of healthy choices in the hospitality industry, reflecting Britain's growing interest in healthier eating. This is demonstrated in the veganism trend, which stepped forward into the mainstream at the start of the year, when an estimated 250,000 people signed up to the Veganuary campaign. The trend is no flash in the pan: two-thirds (65%) of the leaders surveyed by CGA think it will continue or emerge as a key food trend in 2019, alongside other health-related movements like flexitarianism and clean eating.

The vegan movement has prompted many restaurants, pubs, bars, hotels and foodservice operators to rethink their provision. But vegans themselves still don't think they are adequately catered for, with lack of choice, lack of imagination and the same few vegan standbys on menus cited in CGA research as frequent frustrations when they eat out of home.

For now, veganism is just one part of the complex healthy eating agenda that dominates menu development and trend-watching guides at the moment, but it's growing fast, and represents a big opportunity for operators. But it's also a threat, because businesses that fail to respond to it risk seeing a growing market slip away – to existing rivals or new operators that are better focused on vegans' needs.

The need for sustainability

Hand in hand with this interest in health is a growing awareness of sustainability in eating out. Half (49%) of leaders think this will emerge or continue to be a key food trend this year, and CGA's BrandTrack survey shows that four in five (80%) consumers now consider it important that the out-of-home brands they visit use environmentally friendly ingredients. Public opinion has already led many pub, restaurant and bar operators to cut out the use of plastic straws, and to highlight other things they are doing to reduce their environmental footprint, like reducing food miles, energy usage and waste-to-landfill ratios.

"It's clear that sustainability isn't a niche interest any more, but right in the mainstream. It will be crucial for all brands to demonstrate their sustainability credentials in the years ahead, or they are in danger of being seen by the public as behind the game," says Charlie Mitchell, senior consumer research manager at CGA. "This means not just taking actions on sustainability, but talking about them too. Consumers are actively seeking out brands that fit their own principles around environmental practices and social wellbeing. Operators can set themselves apart from their competitors by showing off their commitment to sustainability, and they may well find that it generates extra engagement and advocacy."

Drinking less but better

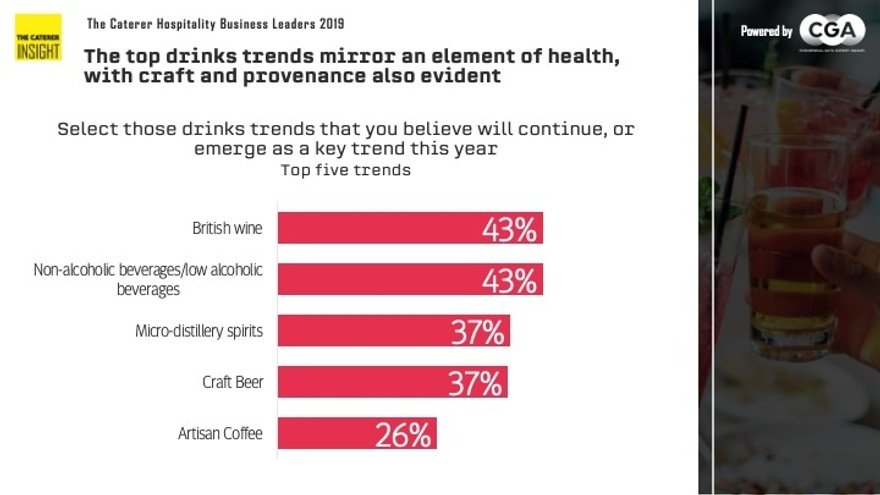

Greater awareness of health is prompting consumers to adjust their drinking habits too. CGA's research has recorded increased interest in soft drinks, especially at the premium end, and a rise in sales of no- or low-alcohol beers and spirits, albeit from a shallow base. And the trend is set to continue, with more than two in five (43%) hospitality business leaders believing the ‘no and low' category will emerge or continue as a key trend in 2019.

This doesn't mean that British consumers are dramatically reducing their alcohol consumption. CGA's data points to only a modest fall in the volume of alcoholic drinks sales lately – but, crucially, it also shows an increase in the value of those sales. That indicates people are drinking less alcohol, but are prepared to spend more when they do.

Public interest in the provenance and authenticity of their food and drink has been rising for many years, but there is no sign of the trend peaking. More than a third (37%) of leaders tip craft beer and micro-distillery spirits as a big trend for 2019 – the latter fuelled by an explosion in interest in gin. CGA's data shows that no fewer than 247 new gin brands have entered the market in the past five years, and licensed premises now stock an average of 8.2 brands – well over twice the average of 3.5 just two years ago. It is interesting to note that interest in micro-distillery spirits is particularly high among hotel business leaders.

Grape expectations

British wine is another good example of the appetite for provenance. More than two in five (43%) business leaders think it will be a key trend in 2019, and it provides both independent and group bars and restaurants with a point of difference on their wine lists. British wine – primarily English but increasingly Welsh – has appealed to drinkers in the know for a while, but it is only now that its full potential is being realised in the on-trade. With people drinking less but drinking better, it is well placed to take advantage of the demand for a premium wine with good provenance and an interesting backstory. The low carbon footprint of British wine producers works in its favour too.

The demand for premium options is also increasingly seen in the casual dining sector, where consumers are embracing new cuisines at the expense of some long-established favourites. For example, recent research for CGA's Food Insights19 report showed that the number of Caribbean restaurants in Britain has more than doubled since 2014, with Middle Eastern and Japanese operators increasing sharply, too.

By contrast, the number of Indian and Chinese restaurants has fallen back in the past few years, especially in the independent sector, while several Italian-focused brands have closed restaurants or collapsed altogether in 2019. Coming up on the outside, meanwhile, are cuisines like Burmese and Peruvian, which, while still niche in the UK, could well become more prominent in 2020 and beyond.

Many of the new arrivals are upmarket casual concepts, and examples of how premiumisation is reshaping the eating-out landscape.

"Consumers have never had so much variety when they visit restaurants, so it is no surprise to find that more and more of them are looking for high-quality, differentiated options with authenticity and provenance," says Rachel Weller, strategic initiatives director at CGA.

"There's still a place for value-led food offerings, but the race to the bottom on pricing may be nearing an end. We're seeing more and more operators seeking to promote the provenance and quality of their products and encouraging customers to trade up – a strategy that has already reaped rewards in the drinks industry."

Experience rules

They are also increasingly looking not just for a good meal or drink, but also for a memorable all-round experience – and operators are responding accordingly. Asked about prospects for different areas of the market, well over half (57%) cited experience-led venues as the segment they feel most positive about in 2019 – more than any other area.

The experiential trend manifests itself in many different ways. The most prominent format is the street food and drink market, which offers consumers a wide variety of options in a communal space and, often, music or other live entertainment. Permanent and pop-up markets are now a popular part of out-of-home eating and drinking, proliferating not just in London but in other major UK cities, too.

Other examples of experience-led concepts include "competitive socialising" formats that combine food and drink with games like darts, crazy golf or table tennis. But CGA's leaders survey reveals a host of other experiential mechanics being used across the pub and bar sectors in particular – like tasting activities (planned by 39% of leaders), pop-up kitchens (25%), live music (24%) and cocktail masterclasses (17%).

CGA's consumer data shows why leaders are now so interested in this area. More than a third (35%) of the population has visited one of these "third-space" venues in the past six months, and they are particularly important in the context of rising delivery sales. If consumers are to be tempted out to eat and drink, it is going to become ever more important to offer them a compelling experience over and above what they can get at home.

In short, experience is everything now. The promise of a great experience is what wins people over to a brand in the first place, and it drives loyalty once they are through the doors. For younger adults in particular it's a big part of their social currency, and when they share their positive experiences on social media, it can give brands a valuable competitive edge.

Nailing the basics

While it is vital for all operators to keep a close eye on these and other food and drink trends, it is also important to note that what consumers want more than anything from their restaurants, pubs and bars are the fundamentals of hospitality. More than three-quarters of consumers (78%) and a similar proportion of leaders (70%) think food quality is a significant contributor to the eating-out experience, while nearly as many consumers (67%) and leaders (62%) think the same about service.

The clear message here is that while it is important for hospitality businesses to respond to big food and drink movements, there is little point in doing so if they don't execute to high standards. Consumers have a great many out-of-home eating and drinking options now, and success can be earned only by combining an awareness of trends with consistent delivery – day in and day out.

The report

The Caterer's Hospitality Business Leaders Report, powered by CGA, surveyed more than 500 top bosses from across the restaurant, hotel, foodservice and pub and bar sectors. They were quizzed on how confident they are about their markets, how their business is performing, what their priorities are for the year ahead, the trends they are experiencing, and what they think are the biggest challenges and opportunities for their businesses.

Continue reading

You need to be a premium member to view this. Subscribe from just 99p per week.

Already subscribed? Log In