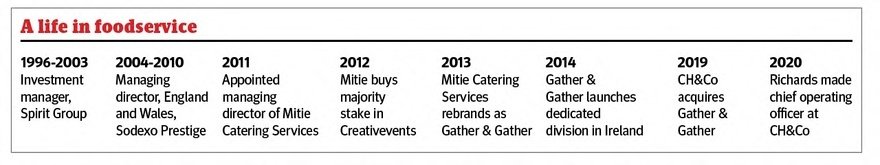

Allister Richards on moving on from mergers and starting a new chapter for CH&Co

Allister Richards, CH&Co's chief operating officer, speaks to Lisa Jenkins about ramping up contract-site spend, adding value rather than volume with acquisitions, and solving the staff crisis – plus, what he looks for in his colleagues.

The Caterer last spoke to you in April 2015 when you'd just completed a rebrand as managing director at Gather & Gather. A lot has happened since then…

Indeed. CH&Co bought Gather & Gather in September 2019 and since then CH&Co has introduced further operational restructures, some of these due to the pandemic. I was made chief operating officer in March 2020, and with a strengthened management team we set about a new phase of growth.

What are your responsibilities?

I look after the workplace, education, healthcare, events, venues and destinations sectors of the business. I work alongside our managing directors, supporting them to run their businesses. We've worked together on mergers and acquisitions (M&A) and come out the other side to create an aligned collective management team that capitalises on the strength and breadth of the group, celebrating specialities in each of the divisions. It's my job to help them to flourish with the right resources and support, and enable everyone to work in a joined-up way.

CH&Co had a year of significant growth in 2019 and the business declared its aim of an annual turnover of £500m by the end of 2020. Has this been affected by the pandemic and Brexit?

In lockdown, businesses like ours dropped to less than 30% of our 2019 revenues overnight. We had some key worker sites that traded, but most of it was shut.We've been very open about that, because otherwise there's no transparency about the decisions we've had to make.

It's difficult because if the business is turning over £500m and then it turns over 20% of that, it's still turning over £100m. To a frontline team member who has been furloughed or is working remotely, there's not really an understanding of what that means structurally to the group – things like staying stable in banking covenants, for example – so you have to be transparent as to what those numbers mean.

Our first restructure, stage one, was tidying up some complexity across the group – there were some managing directors changing lanes, if you like – which was confusing for the operator and the external market. Stage two came through our response to the pandemic, which has led us to accelerate further restructuring, partly through necessity and partly to refine our go-to-market proposition.

My ambition has always been to take the CH&Co group – which, by the nature of its M&A, has become quite difficult for the market to understand – to a place where it is easy to understand internally and externally. That will be achieved by having leading brands that are specialists in their markets and more clarity over the group's expertise, so CH&Co becomes more of a holding company framework. We've partly achieved this in workplaces and will continue this process in other sectors.

My priority was to change the narrative of the group. Historically, when people think about CH&Co over recent years, understandably, they think of the M&A success story, they think of Bill [Toner, company chief executive] and the associations. My role is to say M&A is fine, it is part of the strategy and has been very successful, but the business is doing some incredible things with some incredible clients at the same time. So let's change the narrative: let's talk about what we do and provide stability for our clients and staff – a clarity of purpose.

M&A is still part of our strategy, but we don't allow it to disrupt the group. We will follow an acquisition strategy post-pandemic where we can add value to the business, but we are not interested in buying volume for volume's sake: that's not part of our recovery plan. Any M&A must hit key criteria: does it extend or improve our current capabilities, make us more competitive, open new markets, etc? All M&A is going to be cautiously reviewed, as it is difficult to value businesses after a crisis like this. Entrepreneurs still want value for their businesses, and any M&A business must stack up for both parties.

We are not interested in buying volume for volume's sake: that's not part of our recovery plan

To answer your question, we have an internal three-year turnaround strategy for the group to bounce back from the pandemic, called Plan23. With this plan, through organic growth and retention we are aiming to return the business to where it was in terms of full-year 2019 numbers. We're behind the curve now, because the recovery has been slower, but there's lots of activity, lots of tenders, and we're still bidding for and winning those.

Plan23 includes workstreams that look at our food proposition, people and talent, our employment proposition, CSR [corporate social responsibility] and technology, among others. It requires all of our managing directors to take ownership of a workstream within that plan. Rob Frederickson, our managing director for Gather & Gather, is responsible for adjacent markets, and Phil Roker, managing director of Vacherin, for sustainability.

What are the future risks and volatilities for the industry?

In my opinion the biggest risk for all of us in this sector is that most of our contracts have been renegotiated through the pandemic. Our entire industry is sitting on lots of interim revised contracts. We all need to take a breath and repair the balance sheets, make sure that we are re-entering new relationships on a sound financial footing. The next 18 months will be spent negotiating, and not everyone will be satisfied with those negotiations.

Then there's the skills risk. We've had lots of interest for senior roles, but at sous chef, chef de partie, senior commis level, we are struggling. The shortage of staff is a massive risk. Currently, we can divert staff, but we can't continue this way. We are having to predict future staff levels and look at those gaps now. We are looking at job structure, pay and how we reward people properly. We're looking at our working conditions and hours, and anyone who isn't doing this – well, I hope we all are.

We are looking at pay, working conditions and hours, and anyone who isn't doing this – well, I hope we all are

What are your predictions for the business for the remainder of 2021 and for 2022?

There's still opportunity, and there's lots of talk around the ‘if you can't fix it, feature it' attitude. Workplace sites pre-pandemic were over 50% of group volume, so any long-term structural decline in that sector – if we just accepted it – would have an impact on our group and our fortunes, so we must feature the reality that people are now going to work in a different way.

We believe that office-based work will bounce back and recover, but it will come back over a longer burn, with some people only returning two/three days a week. Does this mean we won't achieve as much from somebody for two days per week as we did over five days per week? Well, no. We think if you used to spend £20 over five days you might spend £20 over two days, if what we do in our sites supports those choices. Perhaps we'll keep the spend, with a good spend per transaction. Our offer must justify that spend and incentivise people to buy.

However, some businesses are investing to attract people back so we might overachieve on volumes in some workplaces.

In the education sector, sales performance since schools reopened has been positive and volume is recovering. Private healthcare remains a booming market and public hospitals should return to pre-Covid levels. Our venues business is good, with strong potential for a full recovery, especially as these sites provide options for secondary meeting spaces and possibly workspace too; there is strong demand in Q4 for this side of the business. For our destinations – like the royal palaces, Kew Gardens, Wisley – the recovery will be binary, benefitting from pent-up demand, and we're expecting strong recovery.

Are there any upsides to what hospitality has been through in the past 18 months?

Everyone wants to look for the upsides – it's human nature and admirable to do that, and I get it. But there have been job losses, lots of job losses, and with the impact on people's health and wellbeing overall for our industry, it clearly hasn't been positive.

Has it possibly forced a change in the dynamic of our industry? Yes, I think so, and these changes need to settle and be sustained.

Initially, there was a view that we would all need to recalibrate our view of commercial risk. Frankly, the industry needed to do this, because undercutting each other and committing commercial suicide – and clients knowing they could attract that response – wasn't healthy; it devalued what we do and what we are.

However, there is already a suggestion that this recalibration may be waning, because people are aggressively trying to recover market share. I would have liked to have retained a bit more common sense and regarded ourselves a bit more highly.

Alongside that, we have certainly forged tighter relationships through adversity. We've all had some tough conversations and have a deeper understanding and respect for each other.

We're struggling with a labour crisis now – that's been well documented – but I do think we have a stronger identity around our industry and its role in society post-pandemic. Foodservice is higher up the agenda with government too, due to the likes of people like Kate Nicholls [chief executive of UKHospitality].

The time did allow us to try lots of new things, however. We accelerated plans, consolidated payroll, internal admin, etc – which all needed to be done. We've experimented as an industry, and had some headspace.

How have food trends in the sector evolved?

The trend for healthy dishes will continue with a view to consumer wellbeing, but our customers are also celebrating food and drink again. The visual appeal of our offering will play a key role in the recovery, and we should be careful not to sanitise our industry too much.

Our food director Jeremy Ford has a small team of development chefs across the business, and we've recently relaunched our Gathered Table initiative [see below].

What's your leadership style and what do you see as your strengths?

I like to think I'm relaxed and honest, and not a particularly corporate guy. If I ever catch myself doing a bit of David Brent, I always put myself in check! I think this has helped the business become more approachable and transparent. I'm quite emotionally open, and I've learned to be more vulnerable and acknowledge these vulnerabilities. You need to lean on people sometimes and leverage the power of the team. I don't overdisclose, but you must show a bit of your own self and encourage others to do the same.

What characteristics do you look for in your team members?

From a leader's perspective, I expect a managing director to be a managing director, not a P&L [profit and loss] manager, to own their own market proposition, and if they don't have one to create or forge one.

A managing director has a responsibility to set a vision, create an identity and drive a personality and tone of voice in their market. My view is that CH&Co should be a business that is led by MDs and not by a small executive team. We are an operationally led organisation, but the real talent in any organisation, with the greatest respect, is not me or the managing directors: it's the upward pressure, the young managers. They know more than we do and they're closer to it.

You must give these people visibility and opportunities to fast-track career development. Our Acorn Award winners are excellent examples of this.

The regathered table

CH&Co's Gathered Table brings together the brightest experts in hospitality to inspire, develop and work in collaboration with the CH&Co chefs. They predict and share trends, reimagine workplace dining and help create healthier and more productive teams. The chefs gathered at this year's table include Ixta Belfrage, Will Bowlby, Ollie Dabbous, Ravneet Gill, Robin Gill, JP McMahon and José Pizarro.

Portrait photography by Laurie Fletcher

Continue reading

You need to be a premium member to view this. Subscribe from just 99p per week.

Already subscribed? Log In