Your tea menu is an untapped resource, with opportunities to upgrade your customers to a premium offering and communicate your brand, according to a survey by Tata Consumer Products

Tea is the nation's enduring beverage of choice, but despite a long and illustrious history as a staple hot offering, it is a market that continues to evolve.

Far from just enduring in drinkers' affections, a study carried out by The Caterer on behalf of Tata Consumer Products has shown that tea is growing in popularity, accounting for some 46% of all hot beverage sales.

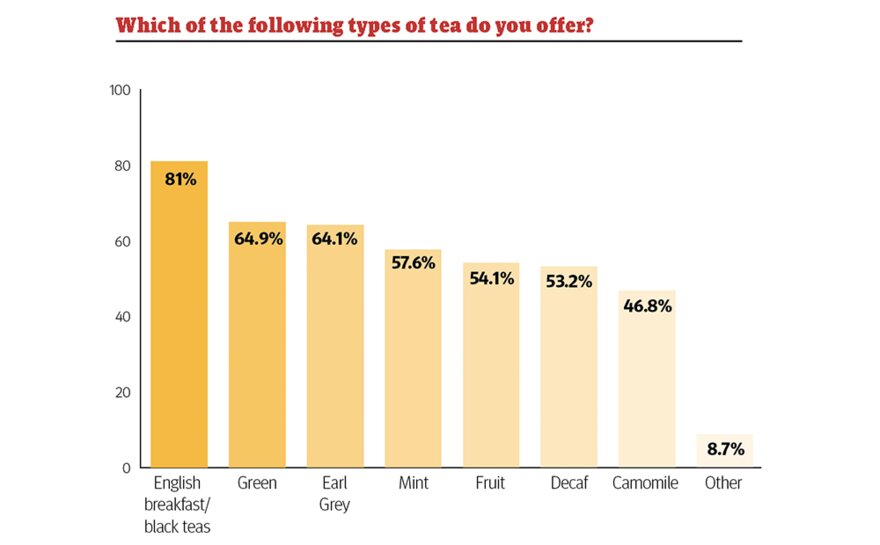

While English breakfast and black teas continue to dominate the market share (equating to 81% of sales), there has been an increase in sales of herbal and fruit teas as well as other premium blends, with some 42% of operators reporting that consumers were becoming more adventurous in their tea tastes.

Brett Grimshaw, director of sales non-grocery for Tata Consumer Products, says: "Tea has come a long way from being just a familiar comfortable cuppa. While still the go-to for many, premium and fruit and herbal teas are surging in popularity. With greater awareness of the high sugar and fat content of some of the more indulgent beverages, particularly those in coffee shops, tea is finding a strong fit with the health-conscious."

Almost half of operators who were questioned said their consumers are becoming more adventurous in their tastes, a trend that provides the opportunity to expand their offerings and entice new consumers.Grimshaw adds: "Of course, it depends on the kind of operation you are running, but for many the days of having just a black tea have gone – you need to premiumise. The big message is don't be afraid to experiment with your tea range – be innovative and evolve it.

"Whatever the out-of-home location, don't overlook functionality. Think range and think format: this could be using envelope teas in an in-room setting for hygiene; decaf tea and flavoured infusions for a care home, catering to requirements for health and encouraging hydration; or the big-format four-pint bags for ease of volume catering. Think of the bigger picture – tea is not just tea!"

More than half of those surveyed offer a broad tea menu, with green tea and Earl Grey topping the popularity leaderboard followed by mint, fruit infusions and decaf. Where other options were offered, these tended to be more specialist teas, such as Assam, lapsang souchong and rooibos.

The survey showed that taste was the key driver for operators when deciding which teas to offer, followed by appeal, the added value of a premium tea, familiarity, cost, and sustainable and ethical considerations.

Grimshaw says: "With more people working from home, the inner-city café shopper is spreading their spending power, so bringing a tea range to the suburbs could really pay off. Premium is relative to what you are selling and a high-end experience does not have to blow the budget. Whatever you consider to be good, better or best options, make sure you have ways to trade-up covered."

Tea demand peaks at mealtimes

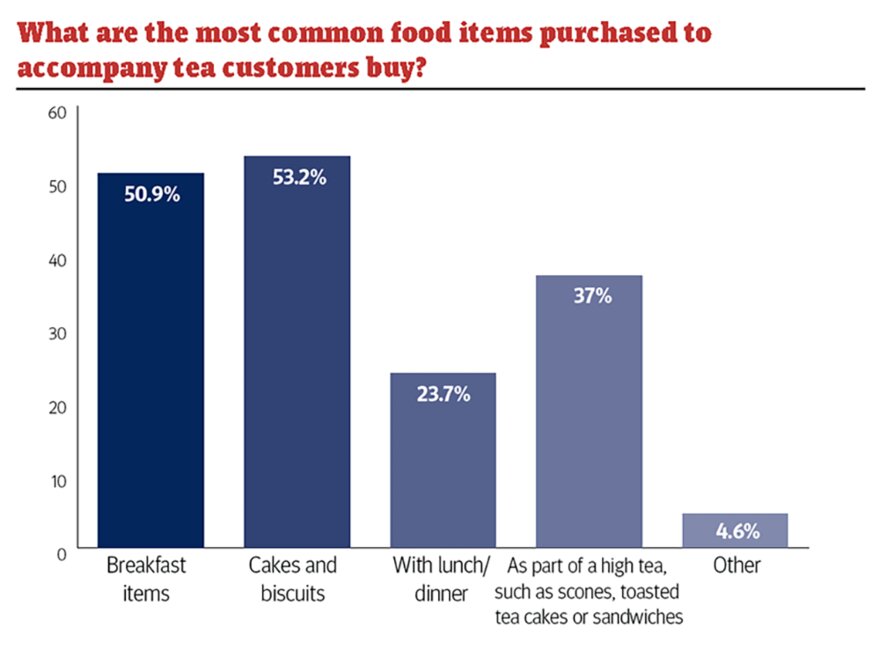

Unsurprisingly, key tea moments peak at mealtimes, with morning and high tea dominating. Over half (53.2%) of operators say that cakes and biscuits are the most popular items sold to partner tea, followed by breakfast items (50.9%) and high tea (37%).

"The right beverage offering can drive sales of food items. Outside of the typical English breakfast pairing, you don't see the same level of meal deal promotions you do with soft drinks, yet given the popularity of tea and its healthier profile, this could be a real opportunity."

Although value for money is a key consideration for consumers surveyed, data shows that they are still spending on out-of-home occasions. And although frequency of visits may have declined, the amount they spend when purchasing tea is holding strong.

Grimshaw says: "For operators, tea is a savvy choice. In difficult times it delivers a higher margin than coffee, especially as you move up the premium scale. We would argue that cost is still a key consideration for many, but would caution against it being a key driver of tea selection – there is no point in having a strong value proposition if you're not selling it. At around 5p a serve, tea represents good value, so don't compromise your entry-level offering."

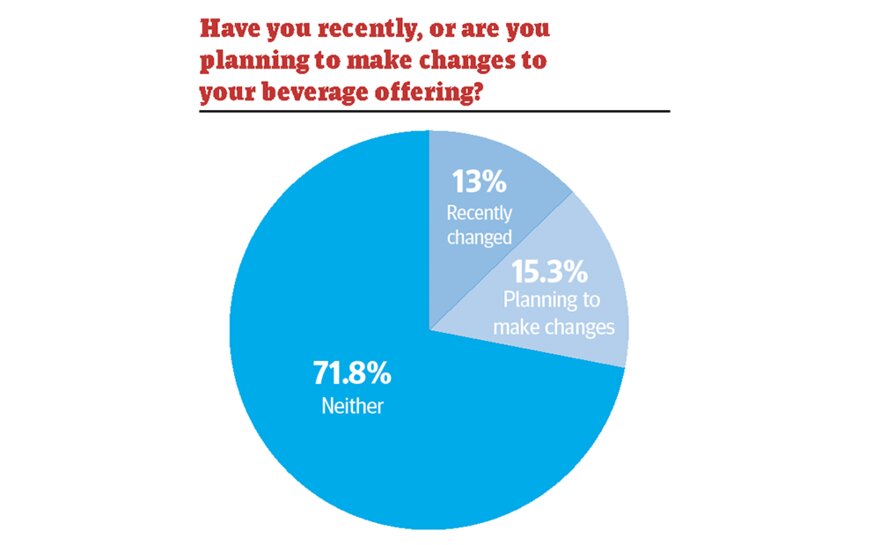

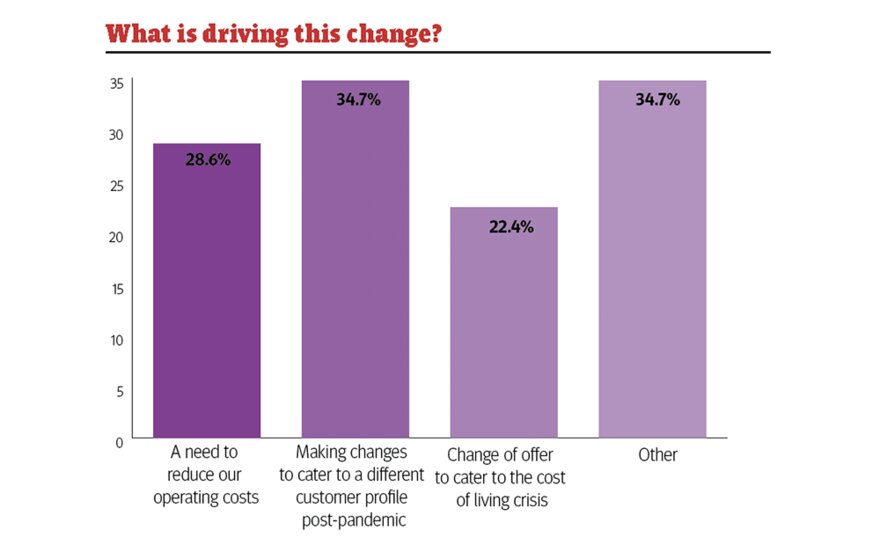

Our research showed that operators are looking at evolving their tea offering as a means to expand sales, with close to 30% having recently made changes or planning to do so. The key reason was to appeal to a new customer demographic (35%), followed by a need to reduce operating costs (29%).

Grimshaw adds: "Given nearly half of all out-of-home hot beverage experiences are tea-based, it is important tea is not overlooked and is reviewed as regularly as coffee. Without the equivalent of the barista, the setting, the occasion and the theatre and experience of tea comes to the fore. Think about how you present it, how you display its availability, and communicate variety, flavour and functionality."

When it came to how tea is promoted out of home, close to 80% of respondents did not have any specific tactic to drive sales, and 61% did not promote the type of teas they had available at all. Yet those that did promote their offering said being knowledgeable about the characteristics of the teas they sell and any suggested benefits to wellbeing helped drive sales.

Grimshaw adds: "If you consider that almost half of the customers of those surveyed choose tea without it being pushed, think of the opportunities if it was curated, promoted and marketed properly, so think of the opportunities that are being missed. Our Teapigs team conducted a trial with a well-known café chain to assess the value of visibility of a premium tea experience. Comparing sales during a month when our teas were literally under the counter to a month when we had branded tea jars and display material in the serve area, there was close to a 67% sales uplift."

Bringing creative magic to tea

Jana Slamova, head of coffee development and beverage specialist at BaxterStorey, explains how the caterer positions its tea offering

"Our reputation is built on delivering the perfect settings for the best quality food, drink and service, wherever it might be, from street food-style vending to university campuses, corporate customers and the finest of elegant dining experiences," she says.

Traditionally, coffee has been a big part of BaxterStorey's offering – Slamova is a previous UK Top Barista winner – but last September its Beverage Academy was born with the mission to transition its baristas to bevistas – knowledgeable experts with a passion to share their craft.

Slamova says: "If it can be drunk, we teach it! Tea has been big for us over the last year and will be bigger still this coming year. Our coffee bars will become beverage bars, charged by bevistas leveraging their knowledge and expertise of different teas, tastes, aromas, preparation and methods of delivery that capture the heritage and the theatre of the tea occasion. Sourcing journeys, ingredient provenance and taste characteristics will form part of the growth journey and our suppliers have a responsibility to convey this.

"In all settings we're seeing palates becoming more curious and exploratory. We have a broad range of teas that includes Tetley as a staple and iconic tea, for the refreshing, comforting break, and the disruptive premium offering Teapigs – modern, premium and visually enticing. With this type of broader sensorial offering, the tea experience can be significantly elevated alongside food partnering, which is good for consumers and good for business.

"In the UK tea is all about an experience and is individual to the person and the needs of the moment. In the nicest way, UK tea drinkers perceive themselves to be experts – they know their tea and how they like it – but there's a big world of tea to discover and we're equipping our bevistas with the knowledge they need.

"We know that the desire is there and believe the potential to be significant, so it's going to be really exciting to see what difference our bevista touch will bring to tea and its value and position in our overall beverage offering."

About Tata Consumer Products

Brett Grimshaw, director of sales non-grocery for Tata Consumer Products

"The way of work and people's lifestyles have changed in recent years and some of these changes are likely to remain permanent.

"As new habits embed themselves, so too does the potential to leverage new opportunities to trade up tea to a higher level, whatever the base. Our mission is to help operators explore new tastes, lifestyle behaviours and opportunities to bring tea to the fore in a way that will deliver stronger sales, improved margins and increased customer satisfaction.

"We are proud of our full portfolio of tea, with different blends and formats to suit all foodservice locations, as well as the in-depth knowledge and passion of the opportunities that exist in tea. With this research we wanted to steer our insight with the beat that's on the street; the challenges, the areas that are under-exploited, and the opportunities for more with a little support and guidance.

"We've been able to use the insight this has given us to produce fresh guidance to hero and benefit from tea, whatever the setting."

In association with