Operators are agreed that customers have money to spend – they're just looking for unique and memorable experiences, according to the Hospitality Business Leaders Survey

With under-pressure consumers carefully considering where to spend their money, staying attuned to your guests' desires has never been more important.

Sales data from the CGA RSM Hospitality Business Tracker confirmed a successful Christmas for hospitality, with the sector reporting sales growth of 8.8% compared to 2022. But in 2024 operators are preparing for a potential decline in discretionary spending.

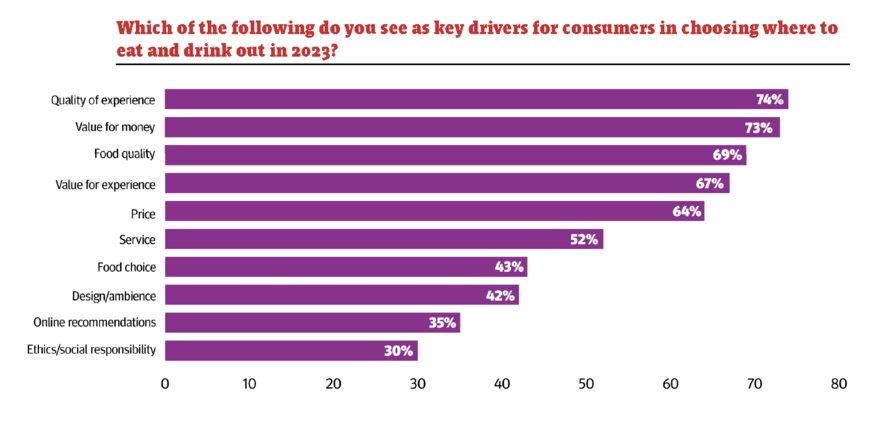

The results of the Hospitality Business Leader Survey 2023, produced by The Caterer and CGA by NIQ, shows that operators are focused on quality of experience and value for money, which are seen as the key drivers for consumers choosing where to eat and drink. These key drivers were highlighted by 74% and 73% of leaders respectively and were followed by food quality (69%), value for experience (67%), price (64%), service (52%) and food choice (43%).

CGA's research and insights director Charlie Mitchell says: "Value for experience is increasingly the main factor that drives visits and leads to satisfaction. With disposable spending tighter than ever, we see that consumers are actually happy to spend a little extra, but to do this, they require more than just great food and drink – it is far more about the overall experience."

Peter Harden, editor and co-founder of Harden's Restaurant Guides, which are based on consumer feedback, adds: "We've seen in our survey over the last couple of years a tendency to mention value more.

"People have had to adjust to seeing higher bills and that's the effect of inflation, but while it may be perfectly reasonable, I have observed that [sensitivity around pricing] has been more acute. But I think that's to be expected over a period of change because people are adjusting.

"While people are adjusting, perceptions are particularly vulnerable. People are very happy to spend large amounts of money when they feel everything is right, but if people are spending what they perceive is a large amount of money, they begin to punish any shortfall very quickly."

Hotel operators were broadly aligned with leaders across the wider industry on consumer drivers, but gave greater importance to service considerations which were considered key by 56% of respondents.

Market confidence

The squeeze on consumer spending is anticipated to lead to a drop in the frequency of eating out by 76% of business leaders, but only 44% expect to see a drop in average spend.

Research has already borne out these predictions. Mitchell adds: "There has been pressure on frequency of visit and, while consumers are still going out regularly, they are carefully choosing the occasions on which they do visit the sector. Late night occasions, with associated higher spend, have fallen off somewhat, whereas lower-tempo, earlier day part occasions have, so far at least, maintained their regularity."

Many operators have moved to encourage footfall, particularly in quieter times of the week, by launching incentives such as set lunch menus offering great value for money.

Charlie Stein, director of Rick Stein restaurants, says: "We've always offered set menus as we like to offer choice for our guests and different menus for different dining occasions. Last year we implemented a new three-course £17.50 set lunch menu at our restaurants in Barnes, Winchester, Marlborough, Sandbanks and St Petroc's Bistro. The menu is great for those looking for a fantastically good value menu that is still perfectly satisfying and gives a taste of what we do. It has been successful in driving additional covers and well-received by guests, so is something we are continuing with currently."

Similarly, Tom Fahey, chef-owner of the Terrace restaurant in Yarmouth on the Isle of Wight, has launched a £10 lunch menu which has successfully driven a dramatic increase in year-on-year footfall.

Harden says: "These menus help to draw in new customers and create loyalty and I definitely think there's been a shift to people rediscovering this. If you have the fear factor about pricing you will be avoidant, but the nice thing about not setting the bar too high is that people can always spend more. I know some people don't, but my feeling is even they may come back and order a bottle of Champagne. You've got them over the line and other people will come and spend more. It seems to me a very good strategy."

Setting the bar

Asked if they were going to make any changes or enhancements to their offers in the next 12 months, 54% of operators said they would be updating their menus and 46% have plans to become more sustainable. Meanwhile, increasing promotions, seasonal food and drink options, and vegan and vegetarian options were being pursued by 36%.

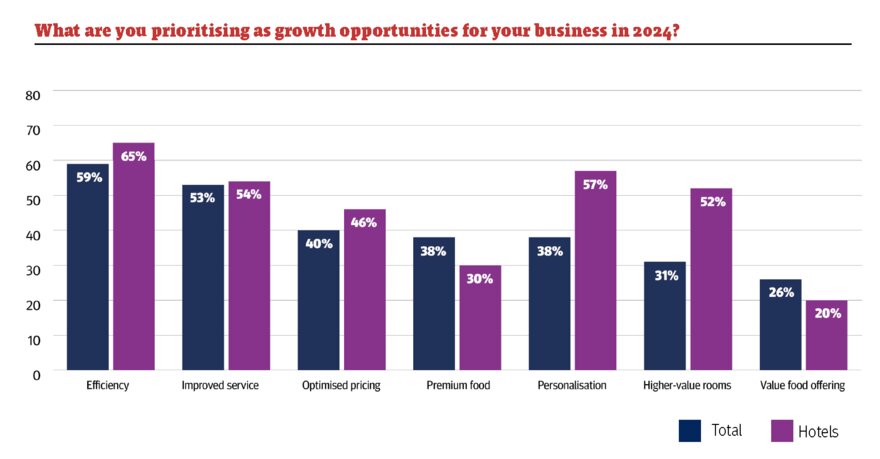

The areas being prioritised as growth opportunities included efficiencies, which were being pursued by 59% of respondents, improved service (53%), optimised pricing (40%) and personalisation (38%). Hoteliers said they were focused on personalisation and pushing higher-value rooms, possibly seeing greater opportunities at the luxury end of the market.

Kalindi Juneja, chief executive of marketing consortium PoB Hotels, said its own survey of more than 3,000 high-net-worth individuals had indicated a consumer drive to increased personalisation. She says: "True luxury at the top end of the market translates to personalisation, but it needs to be a far more tailored and personal approach, as opposed to one size fits all, which is certainly not the case at this end of the market."

Juneja also anticipates the trend towards higher-value rooms to continue. She adds: "Part of this is operators being clever in the way they operate, because the reality is costs are one of the biggest concerns for the sector at the moment. When costs are going up, the focus for many has to be on optimising every element of the operation, instead of being just busy. So the focus needs to be on trying to drive rates and those higher-category rooms. As well as this, the demand from a guest perspective for those categories of rooms has also risen. The UK has incredible luxury hotels and the standard across the board has risen, so the guest is also expecting higher standards."

This continued demand at the top end of the market illustrates that the pinch on people's finances will not be felt equally, but Mitchell believes the industry may by its nature be protected from the brunt of a contraction in non-essential spending.

He adds: "The demographic profile of the hospitality sector visitor is asymmetric. Nobody forces people to eat and drink out, so it is those who can afford it that do. As such, the sector has been somewhat shielded from the worst impacts of the cost of living crisis. Certainly, the most frequent users of the sector are those who are less likely to have been impacted, which is a huge positive for operators who need all the help they can get, with soaring bills and costs to contend with."

Positioned to thrive

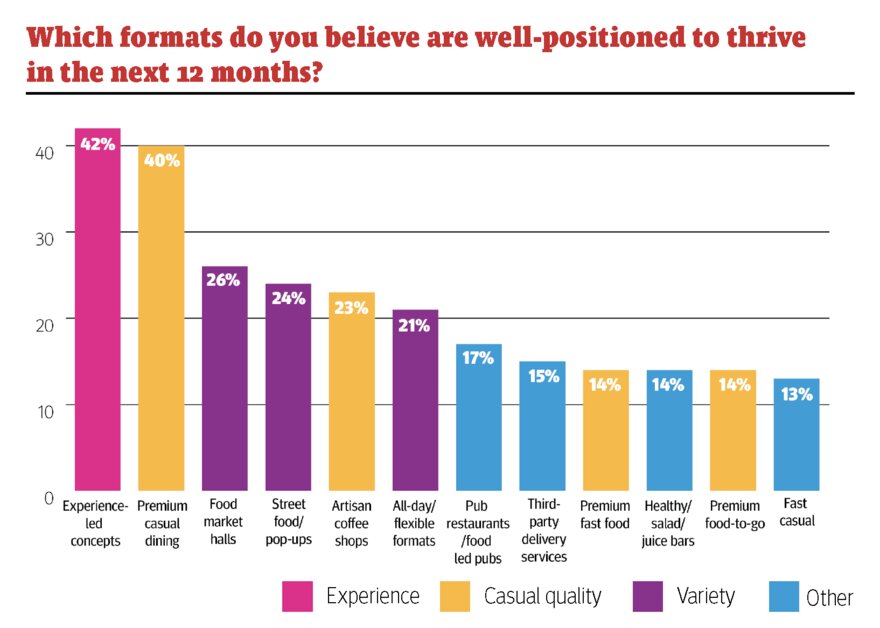

Experience-led concepts were considered the most likely to thrive in 2024, with 42% of leaders saying they were well positioned.

Premium casual dining ranked second at 40%, followed by food market halls at 26% and street food/pop-ups at 24%.

Accordingly, leaders said they were continuing to focus on in-outlet experiences, with 26% planning tasting activities, 13% kitchen pop-us and 11% live music performances.

Mitchell adds: "Experience-led outlets have really benefited from the shift towards earlier day parts and the increased prevalence of consumer planning within the sector. One of the lasting impacts of the Covid-19 pandemic was people wanting to plan their hospitality trips before visiting and searching for something different, especially within city centres.

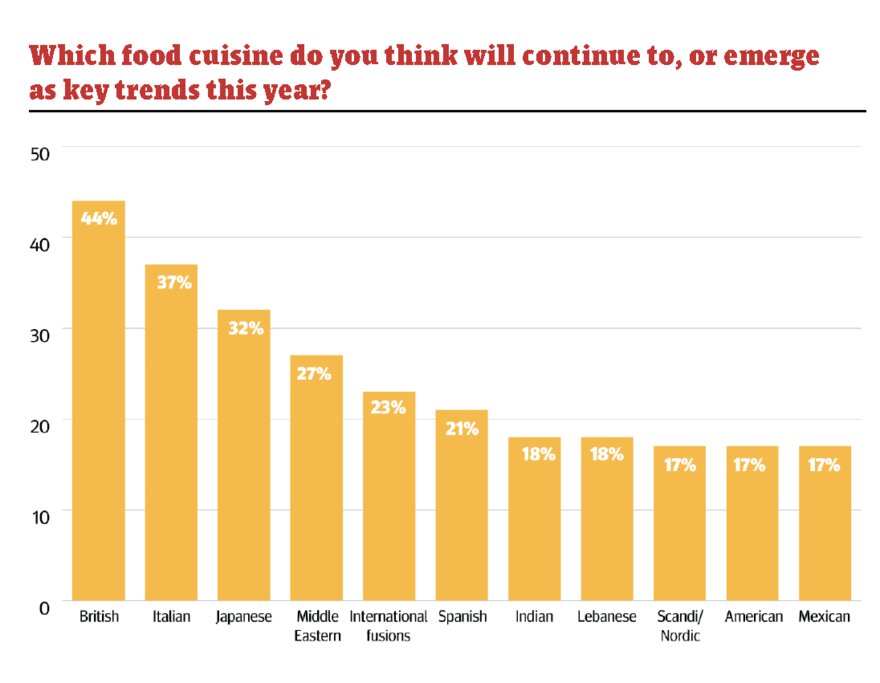

"Experience-led venues are perfectly placed for this and some of the exceptional operators in this space have really taken advantage of it. Less boozy, more fun and showcasing that value for experience aspect are the likes of Flight Club, Swingers, Sixes and many other operators that are providing consumers with great hospitality experiences." Leaders anticipate that familiar cuisines will retain its popularity in 2024, with British cuisine expected to continue or grow its popularity by 44% of respondents, Italian by 37%, Japanese by 32% and Middle Eastern by 27%.

The food dietary, ingredient and production trends expected to continue or emerge this year were farm-to-fork production (61%), sustainable sourcing (53%), gluten-free food (51%) and ethically-sourced produce (46%). When it comes to drinks, British wines were cited as the top trend anticipated by operators, followed by craft beer, artisan coffee and virgin cocktails.

International tourism is the only area where business leaders anticipate seeing significant net growth in 2024, with 11% predicting significant gains, 52% slight gains and 25% no change. When it comes to domestic tourism, 36% believe it will increase slightly, while 29% expect no change.

VisitBritain forecasts 39.5 million visitors will travel to the UK in 2024, up 5% on 2023 although 3% shy of 2019. The body predicts spending by international visitors will be £34.1b, up 7% on that predicted in 2023. Mitchell says: "Tourism thoroughly bounced back in 2023 and none more so than luxury tourism. With the financial polarisation we are seeing across the globe, there has been a huge uptick in higher-income consumers travelling and looking for luxury experiences. However, we are also seeing this phenomenon in other income groups, many of whom are looking to treat themselves and pay slightly more for a better-quality holiday."

While the there is clearly some nervousness around consumer spending in 2024, it's clear operators see areas for optimism and are actively readying their businesses to respond to consumer trends.

'One of the most surprising things is how resilient the economy and the consumer have been'

Tim Rumney, chief executive, BWH Hotels GB

"Despite all the economic shocks over the past couple of years, one of the most surprising things is how resilient the economy and the consumer have been to the onslaught of higher costs and lower discretionary spend.

"I am reluctant to mention the C word but the Covid pandemic has certainly had an impact, with some consumers having built up a savings pot during lockdown and everyone keen to have fun following the enforced absence from people and places.

"Hospitality spend has moved from a desirable to an essential item on the shopping list and events have also driven accommodation and catering spend. UKHospitality research backed this up at our annual conference, with visits to hospitality venues being described as "vital" for consumers. 40% of respondents plan to prioritise visits to premises for experiences. This is the number one priority, ahead of spending on clothing, home improvements and international holidays, so there is a reason for optimism, which is filtering through to our owners and operators.

"Nearly three-quarters of our hotels when questioned at our annual conference said they were ‘moderately optimistic' or ‘very optimistic' about trading in the next 12 months and that their optimism was 48% higher than this time last year. A further 37% said their optimism levels were the same as last year, with only 15% saying they were ‘more pessimistic'. Not only that, but our hotels are looking to invest in their properties at higher levels than in recent years too, so we just need the continued support of the banks and the institutions to stick with hotels recovering post-pandemic.

"To the Instagram and TikTok generation, experience and sharing is everything, so operators need to have that in mind when investing and it doesn't need to cost the earth.

"Service and experience have always been hallmarks of a great stay, but the unexpected is also something I think we will see more of this year, too. Hotels, restaurants and bars are looking to differentiate in areas away from the traditional cost lines in profit and loss. A hotel with a popsicle hotline was an example given at our recent conference; a hotel with a choice of lift music; a hotel with a hidden beer tap in the cupboard that guests have to find – cookie-cutter just doesn't cut it anymore.

"The Kano Model [an analysis tool that measures customer needs] has always been part of our DNA by providing moments of unique and individual delight that stay in the memory longer than just the perfunctory must-haves in a hotel. The excitingly unexpected is a trend that unites demographics, and as hotels get braver I think it will be something that will create more reasons for even the cost-savvy traveller to book, stay and share.

"Our conference theme was ‘Celebrating Change' and now is the time to look forward with optimism but also innovation."

'I believe we are facing a crucial moment'

Colin Butler, UK and Ireland managing director, Unilever Food Solutions

"I believe we are facing a crucial moment where business success hinges on our ability to understand and adapt to evolving consumer trends. Those who tailor their services to meet consumer demands are poised to thrive in this ever-evolving landscape.

"With one in four households facing financial challenges, the cost of living squeeze continues to shape consumer behaviour. Choosing dining destinations based on quality, experience and value is now the norm. To succeed, operators must elevate their offerings to deliver unforgettable dining experiences. Using quality ingredients, providing dietary variety, and developing low-waste menu options can enhance perceived value without increasing costs.

"While financial constraints may limit the frequency of eating out, there's an opportunity in the expectation they're happy to splurge when the right occasion arises. Operators should focus on attracting consumers with promotions for special occasions, giving them a reason to choose your establishment for memorable moments, potentially even increasing their average spend.

"The rise of experiential concepts signals an opportunity for restaurant owners to create immersive and engaging dining experiences. Interactive elements, themed dining experiences and live entertainment can resonate with customers, enhancing their overall dining experience.

"The trend towards premium casual and food halls aligns with demand for new cuisines, dining variety and evolving tastes. Constantly changing menus is a challenge, but this diversity offers exciting opportunities for experimentation with unique culinary offerings – and to support chefs, our Future Menus report explores upcoming food trends, sharing inspiration and recipes tapping into this variety.

"For hotel operators, it's exciting to see a resurgence in the tourism market. Leveraging the locality of their restaurants by collaborating with local attractions and suppliers can promote unique offerings or cultural experiences that spotlight regional cuisine in their menu. Exclusive, personalised services catering to the resilient top-end of tourism will meet the demand for luxury experiences. Hoteliers must focus on service alongside quality and value – our UFS Academy offers training for chefs, front of house and management to help deliver impeccable customer service from kitchen to table, creating a positive and memorable stay for guests.

"Proactive adaptation is key for our industry, By implementing innovative menus, enhancing special occasions, embracing experiential concepts and focusing on service excellence, businesses can not only overcome challenges but also thrive. Let's embrace change, stay agile and keep customer experience at the front of our minds to secure long-term success."

'Quality of experience and value are still key drivers'

Morag Freathy, managing director, business and industry, Compass Group UK & Ireland

"There is no doubt that quality of experience and value are still key drivers across our business and industry workplace catering offers. We compete with the high street, so driving innovation, creativity and choice is key. However, in my opinion, where we make the biggest difference is offering all of this alongside great value.

"We all know that since Covid working patterns have fluctuated and, with the war for talent continuing, food and drink are being leveraged more than ever. This is a way to offer a benefit that will help retain and recruit people, as well as play an integral part of back to the office strategies.

"Our own data is telling us that it's the fourth most important benefit employees look at (flexible working hours is number one). Where workers have a canteen, they recognise this even more and it goes up to the second most important benefit.

"Quality food and drink should be the focal point for a great break and fundamental to workforce performance and productivity, as well as bringing teams together. Many of the clients we work with don't have the option for hybrid working, so good-quality breaks are vital. Seventy per cent of Gen Z agree that what they eat and drink at work directly impacts their productivity. I would say this supports the growing need for a decent F&B provision to support staff.

"In terms of budget, our research suggests people want to spend around £5 a day on food and drink at work. Where hybrid working is possible, we are seeing people using their weekly budget across fewer days in the office. The expectation is that customers generally want a hot meal for under £5 and the rest of their weekly budget goes on other items and drinks.

"In terms of trends, we're nudging people to make healthier and planet-conscious decisions and our reformulation of some of our recipes has led to a 40% meat reduction across the top 12 best-selling dishes in our business and industry sector. A good example is our spaghetti bolognese, where 40% of the beef is now replaced by beans and lentils – it doesn't impact the taste and quality, and it hasn't impacted sales either, but instead has a huge impact on emission reduction. A total of 50% of dishes are now plant-based within Compass' business and industry sector.

"Coffee and hot beverages are also important and there is no slowing of sales in the workplace. Interestingly, lattes are increasingly becoming the drink of choice, overtaking tea and other coffees. In the cost of living crisis, we are seeing that often small treats become an affordable choice."

In association with: