There is cause for optimism, says the latest Hospitality Business Leader Survey 2023, with respondents feeling more hopeful despite facing a plethora of issues

Despite a challenging year, optimism among hospitality business leaders has jumped by eight percentage points as enterprising operators find opportunities even in stormy weather. The Hospitality Business Leader Survey 2023, produced by The Caterer and CGA by NIQ, reveals that 48% of respondents feel optimistic about the industry's prospects over the next 12 months, with less than half that number (21%) feeling actively pessimistic.

The results mark a considerable uptick compared to last year's survey, when 40% felt optimistic and 43% pessimistic, but are still a sharp decline on the figures seen in 2021, when 80% of leaders felt optimistic.

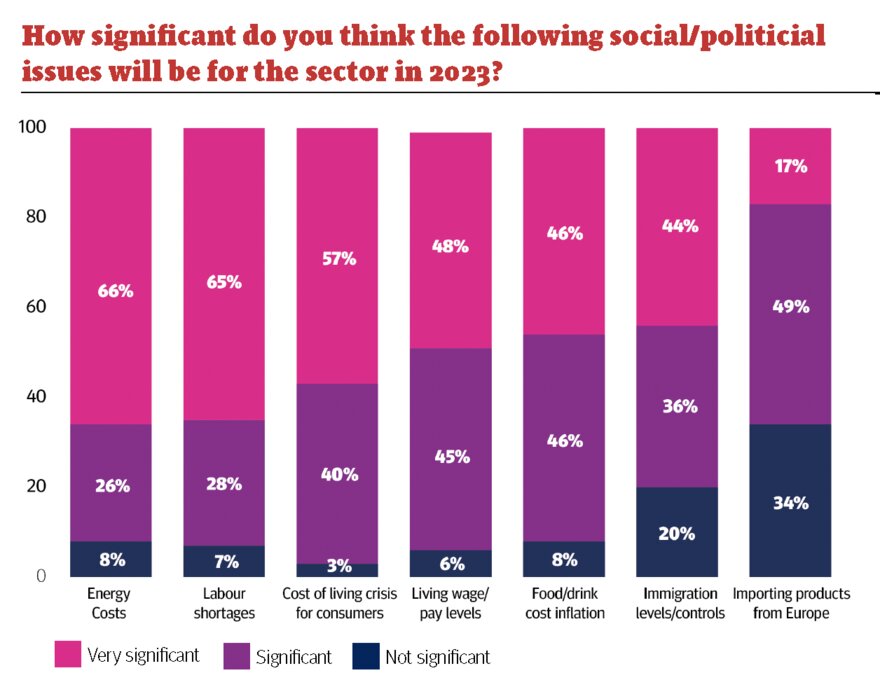

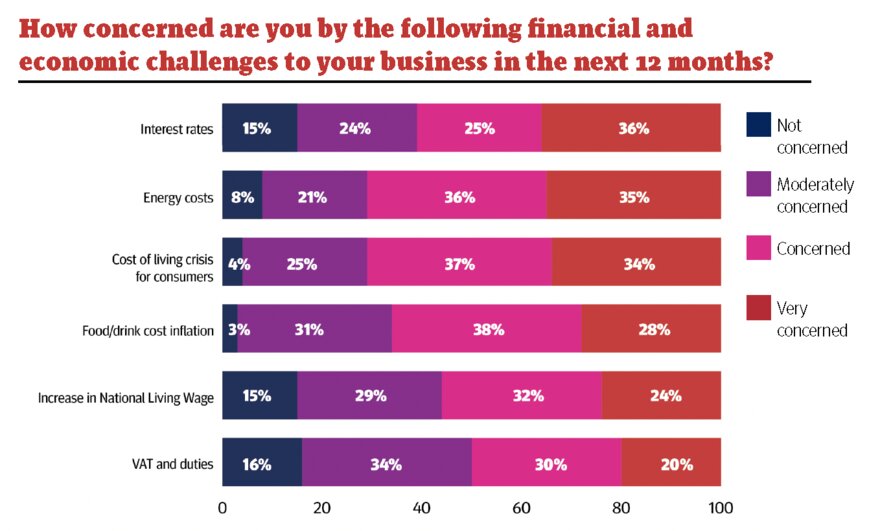

The pressures faced by the industry have been much reported in the past year and highlighted in numerous financial documents showing dramatically eroded margins hitting the bottom line. Accordingly, while more optimistic operators are by no means complacent, with more than one-third stating they are "very concerned" about interest rates, energy prices and the impact of the cost of living crisis.

CGA's research and insights director Charlie Mitchell says: "Optimism for the market has once again jumped from last year, but what is really telling is the converse and the fact that there is far less pessimism in the sector than there was last year. In fact, the figure for operators who feel pessimistic about the sector as a whole has dropped by more than half compared to last year.

"Of course, what cannot be ignored is that, in that time period, we have also lost a lot of operators along the way. As a result, many operators have fewer competitors or are more likely those who were already optimistic, as they hadn't had to face the same degree of challenges that those closed operators failed to overcome.

"That said, the gains in optimism should be celebrated, given the context of eroded margins, and serve as proof that the hospitality sector is adapting to an increasingly challenging environment."

As ever, across all sectors, leaders feel more optimistic when it comes to their own business, with 67% feeling positive compared to 19% who feel pessimistic. Among hotel operators, 61% are optimistic about their own business's prospects, compared to 21% who feel pessimistic.

Delving further into these results, the operators of London hotels are more optimistic than those in the regions (65% compared to 58%), while leaders of hotel chains have a more positive outlook than those behind independent businesses (74% compared to 51%).

Mitchell suggests this may be because hotel groups have been able to negotiate rates and headwinds more easily than independents. Data also shows signs of a squeezed middle with luxury and affordable hotels performing more strongly than the mid-market.

The bottom line

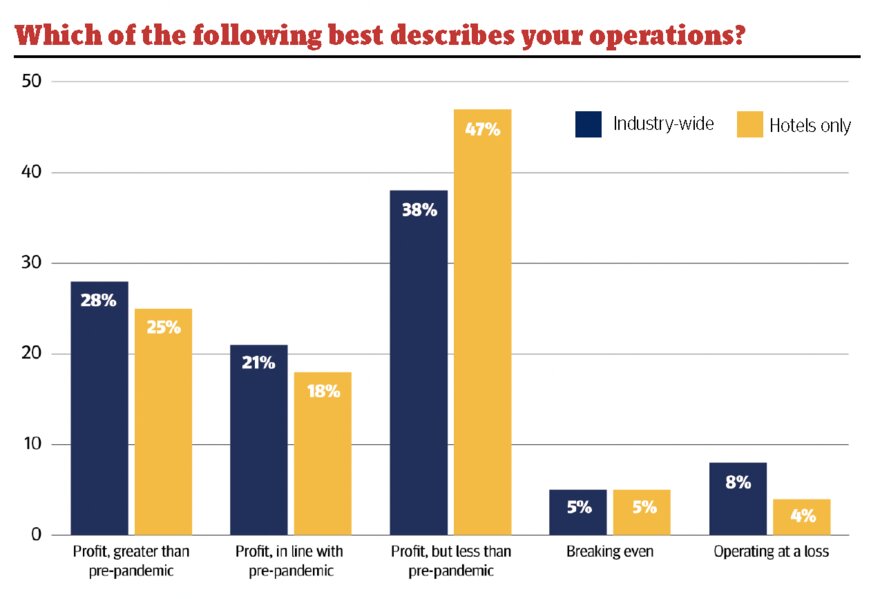

Despite the backdrop of cost pressures and inflation, nine in 10 business leaders report that they have made a profit in 2023, although at a lower level than in previous years. Some 38% say they are in profit, although below pre-pandemic levels, while 8% report they are operating at a loss. This comes despite all segments apart from bars having seen year-on-year sales growth, in a reflection of how tough the market is.

Interest rates are the number one concern for business leaders, with 36% "very concerned".

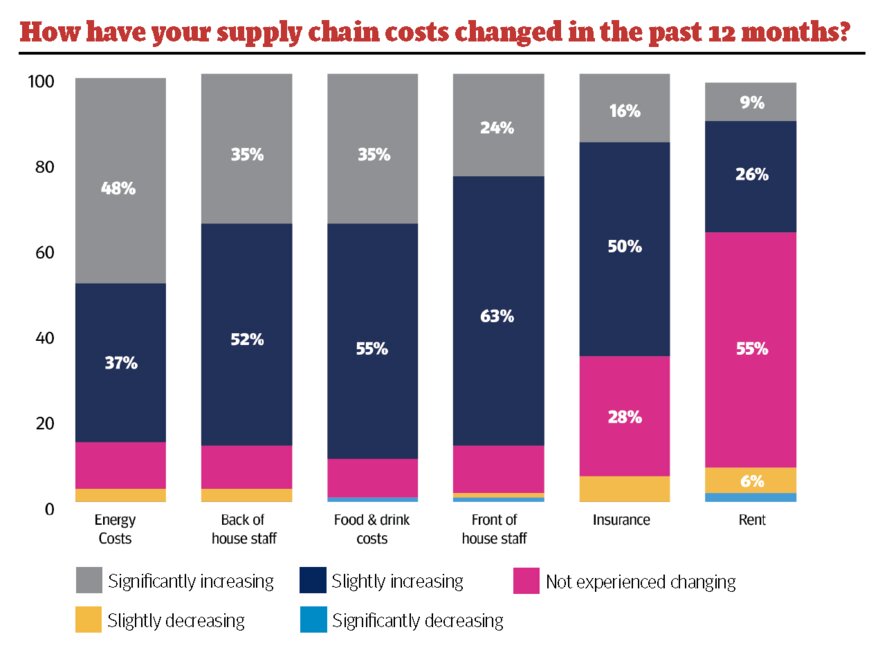

Energy costs, the cost of living crisis and food cost inflation had 35%, 34% and 28% of leaders "very concerned" respectively. An unsurprising result, given 48% of business leaders reporting that their energy costs had "significantly increased" and a further 35% saying food and drink costs "significantly increased". Back of house staff costs have also "significantly increased" say 35% of respondents, with 24% of business leaders saying the same about front of house staff, a situation likely to come under further pressure when the National Living Wage sees the largest increase in its history in April.

Tomas Maunier, co-founder of Fazenda restaurant group, which made its London debut this year, says we continue to be in "scary times for the industry".

"My feeling, having spoken to people from a lot of regions, is that right now hospitality is a story of two extremes," he explains. "The numbers are really scary for a lot of people. Inflation is starting to slow, but inflation slowing does not mean there are no price increases.

"The independents are in a really, really tough space, but there is this dichotomy of people at the top doing really well, and we are one of them. I don't know why we're seeing numbers growing across all sites – I think we've been lucky, and others have been lucky – but I know a lot of people have not been as lucky as we have."

Mitchell agrees that the market outlook continues to be tough but offers hope: "The market undoubtedly remains difficult, and conditions are tough, with costs continuing to rise, and consumers increasingly watching what they spend.

"However, hospitality can rely on the fundamental and basic human need to socialise as a buffer to the full brunt of those changes. All of our consumer research points to the sector as the last item of discretionary spend that consumers would want to give up, but only if experiences meet expectations – so it remains pivotal that operators deliver on this, which provides a further challenge to the increased costs faced."

Passing the pressure

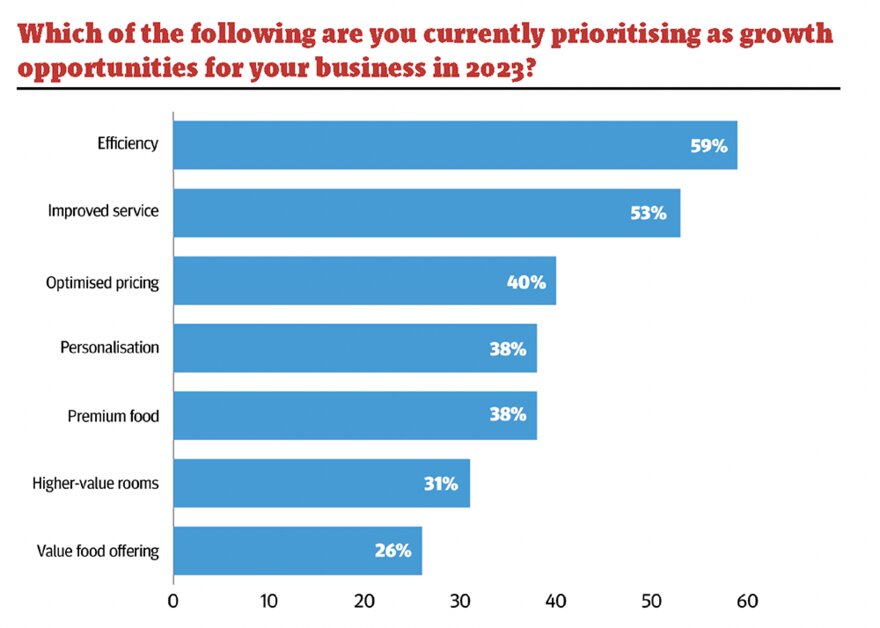

Costs are being passed on to consumers and just 9% of operators say they won't be increasing prices further in the next 12 months, with average increases of 14% seen.

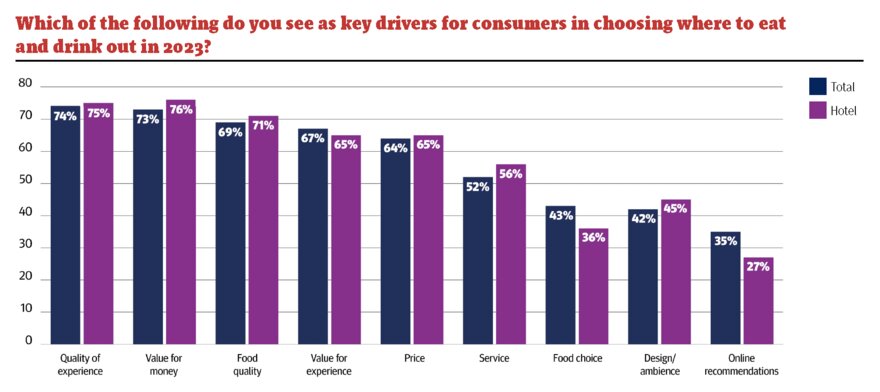

The confidence to increase prices is reflected in business leaders' opinions on what is driving consumer spending, with price the fifth most important consideration.

When it comes to driving footfall from cash-strapped consumers, 74% of business leaders say quality of experience is key in choosing where to eat and drink, followed by value for money (73%), with food quality standing at 69%. At the other end of the scale, ethics and social responsibility are thought to be decision-drivers by only 30% of operators. Mitchell says: "Pre-pandemic we did see the likes of ethics and social responsibility rise in consumers habits and decision-making in the hospitality sector, as it was more of a focus than ever before. Then, during the pandemic it was also a big factor, while guests wanted to ‘support local' and were happy to potentially pay more to do so.

"Fast-forward to 2023 and, while the macro-trend of looking for sustainable, ethical and responsible products is stronger than ever in the retail sector, it hasn't had the same impact in hospitality – certainly not to the extent that it is a determining factor for the majority of consumers in where to visit."

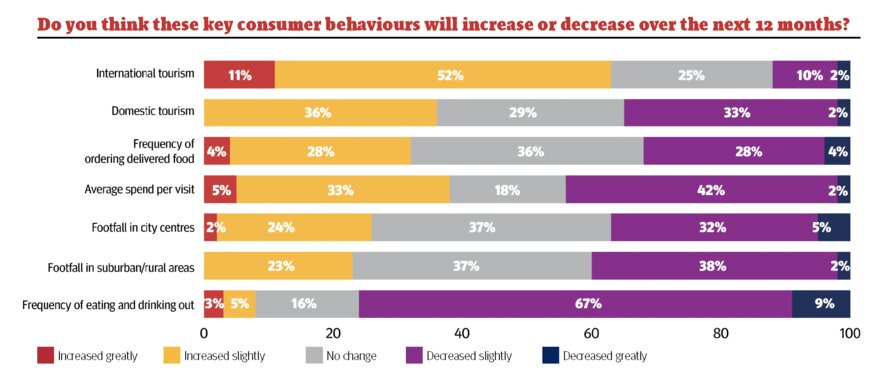

As the cost of living crisis continues to see consumers spend savvily, 76% of business leaders expect to see a drop in the frequency in eating out, but only 44% expect to see in fall in average spend.

Areas for optimism

International tourism is the area in which leaders are most confident of seeing significant net gains, which appears to be reflected in the number of new hotel openings in recent months. However, Joanne Taylor-Stagg, general manager of the Athenaeum hotel on London's Piccadilly, believes another bounce in domestic tourism, should not be discounted. "The one thing we can be certain of is that we live in a volatile world. We've got used to lots of change and that's not going to go away," she says.

"I think the geopolitical situation makes people nervous to travel and we may see less inbound tourism in 2024, particularly from the American market. We know they're feeling nervous and we've seen previously that they don't tend to travel as much in an election year. So, the international market is likely to see contraction, but the same factors also apply to domestic travel and I think we'll see another bounce in domestic tourism. All the statistics show that although people are nervous about the cost of living, the pandemic has taught us to value our time together and people continue to prioritise socialising and going on holiday."

Taylor-Stagg also suggested that there may be some unexpected good news for operators in the next 12 months: "We'll have an election in the next 18 months, so we might see the government putting forward some ‘quick wins' ahead of that. The fact they're looking at business rates is crucial, and it would be great to see tax free shopping for tourists reintroduced, as I really do think that has made London less attractive to international tourists. With the election imminent we might just see some of those things come through quicker than we would otherwise expect."

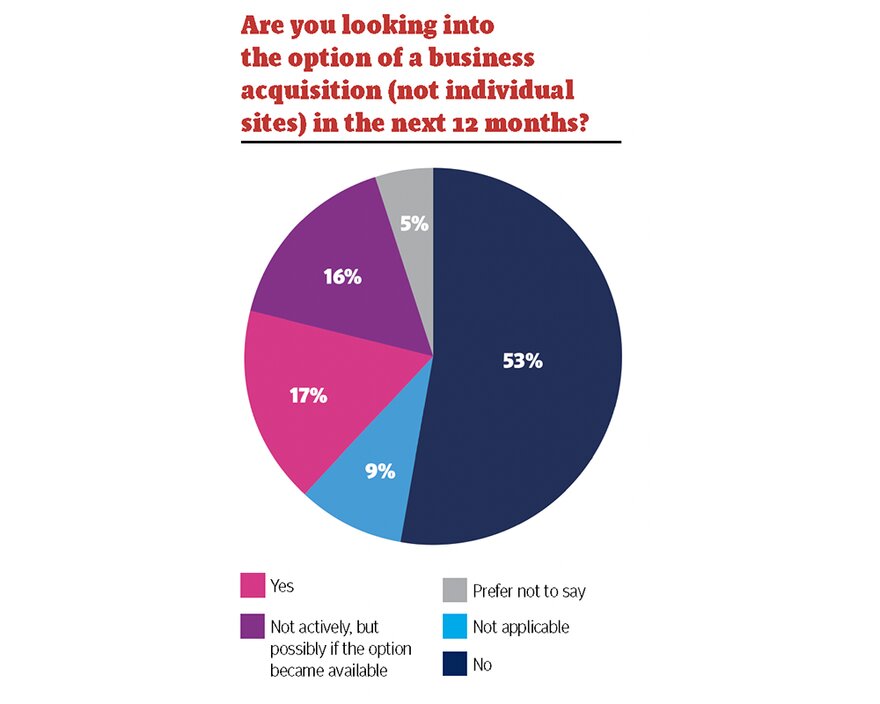

Despite the pressures being faced, investor confidence is the issue of least concern for business leaders, which suggests the long-term view of the sector is more positive. Leaders are also confident they can manage their debts and estate costs, with 34% saying they were "not concerned" about these areas. This is reflected in an increasing number of operators planning to grow their estates in the next 12 months, with almost half of respondents to the survey saying they were planning an opening at least one new site.

This growth was driven by restaurant operations, although the majority of pub operators also had plans to expand, albeit at a more modest scale. Restaurateur Sam Harrison, behind Sam's Riverside, Sam's Kitchen and Sam's Waterside in west London as well as three Sam's Larder sites, says that although margins are "the hardest I've ever known", he has expanded the business. He explains: "We've opened four sites in the last 12 months and I think there are things to be optimistic about and some fabulous opportunities. Fundamentally, I still believe in hospitality and restaurants and I believe if your product is good enough people will come. People want great food, a great atmosphere, to be looked after and to perceive they've received value for money. If you can offer all of those things, then there are still opportunities.

"You do have to take a long-term view. At Sam's Waterside we have a 20-year lease. Of course, we're in business to make money, but it's not just about making money today, it's about building restaurants that survive and flourish, so through the more difficult times I think you have to accept you can't be more profitable. The easy thing to do would be to put prices up and cut your wage bill, but where does that leave you? I want to be here for 20 years and I think if we were to stop offering the same quality of product to the customer it would come back and bite long term."

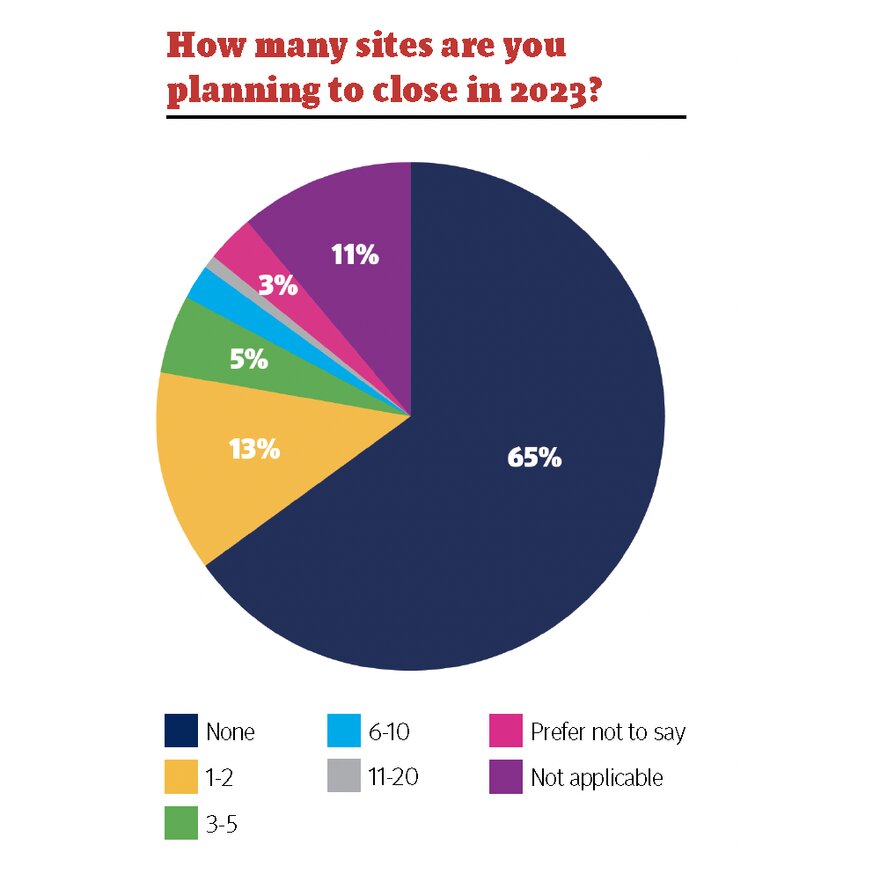

While the Hospitality Business Leaders Survey shows expansion is largely confined to those already operating multi-site businesses, no single-site operators say they are planning to stop trading in the next year. Conversely 21% of business leaders are anticipating closing sites in the next 12 months, suggesting the market can expext a certain level of churn.

Growing market activity is also visible in the increased number of operators considering business acquisitions, with a third of leaders currently open to the idea.

What's clear is that while conditions continue to be challenging, green shoots of optimism are apparent and industry-wide business leaders have no intention of resting on their laurels.

Compass Group UK & Ireland

Chris Chidley, chief growth officer, Compass Group UK & Ireland

"The outlook for contract catering outsourcing remains positive for the year ahead. In 2023 Compass Group UK & Ireland has seen a period of significant growth. In addition to achieving strong retention of our clients, we have won more new business than previous years, with a high proportion coming from first-time outsourcing. We are seeing more organisations wanting to solely focus on their core business, recognising that outsourcing partners can deliver better value, services and expertise. With a turbulent economic backdrop, it makes the case for outsourcing even more compelling, as we bring stability. With this comes an opportunity for growth.

"Within the market, across private and public sectors, we are seeing the growing importance of food and drink, with clients leveraging offers as part of their people attraction and retention, as well as back to the office strategies. We know we compete with the high street, and with inflation set to remain high, the value we can deliver is crucial. During 2023, we have grown our procurement business, Foodbuy, to enable us to increase our purchasing power, so we can continue to mitigate risk without compromising on quality, driven by our size and scale.

"The global food services market is worth at least $300bn, and Compass Group is the global leader with around 15% market share – so we know there are opportunities afoot and I remain optimistic."

Best Western

Tim Rumney, CEO

"The Festive Season is upon us and for a hotelier that's always a double-edged sword. Lots of demand, high expectations and merry customers along with often stretched resources, both human and physical, and busy tills with hopefully a profitable outcome – and then January…

"Given what we have been through over the last three years (I won't do the list) I think that we have to be hopeful that in the absence of a black swan event there may be a steady improvement, or at least some stability in 2024. Inflation is heading down, interest rates have stabilised and the staffing crisis might be easing. However, costs are still high, the market is flat and consumer spending is still under huge pressure.

"There are still challenges ahead but, that said, we do find reasons to be optimistic at BWH Hotels. There has been a bit of a big business backlash from consumers in recent years. Many consumers are proud to book, stay and support independent businesses. We have been a flag bearer for independence for over 50 years in Great Britain and our research has shown over 80% of hotel booking consumers want to support local and independent. So, I am optimistic that this trend will continue supporting our hotels in leisure sales and we have also seen a resurgence in corporate bookings and M&E in the last 12 months, which gives me more reasons to be positive.

"But also, as an industry I think we should be optimistic about providing the simple, meaningful and memorable things well. When consumers spend with us, we need to remember they have many choices and because of the squeeze on spending, where they buy, really matters. So, we need to focus on providing value over cost. By providing an experience, not just another transaction. By getting back to the great hospitality basics that make people want to go out, want to stay over, want to eat, drink and experience everything this great country has to offer. If we focus on what we are brilliant at and where we can make a difference, maybe optimism won't be so fragile."

Unilever

Sarah Branagan, marketing director, Unilever Food Solutions UKIANZ

"In a world where hospitality sector confidence balances on a knife-edge, the recent Business Leaders Survey reveals a nuanced outlook for the industry that offers a source of encouragement. Despite ongoing economic concerns and recent challenges caused by the Autumn Statement, there are glimpses of optimism around staffing and expansion – suggesting a cautious readiness to embrace change and pursue strategic growth during a critical period.

"Unilever is built around a community of chefs, so it is particularly reassuring to see leadership commitments to employee retention that should result in our industry retaining more talented individuals. Our #FairKitchens movement, co-founded in 2018, campaigns for stronger kitchen leadership and culture, so this is a welcome step toward creating more positive and innovative hospitality environments.

"Encouragingly, Manchester and Liverpool have both experienced a net increase in hospitality openings – presenting a vision of opportunity amid the sector's current uncertainties. As consumer demands for quality rise, the industry must now navigate the task of creating unforgettable food experiences, while delivering exceptional value and sustainable solutions. A complex challenge, no doubt – but one we can tackle with our usual determination, adaptability and resilient spirit."

In association with CGA, Best Western, Compass Group and Unilever Food Solutions