Ties that bind – US Food Trends

R&I's 2008 New American Diner Study illuminates consumer dining patterns.

This article first appeared in the 1 January 2008 issue of Restaurants & Institutions (R&I).

R&I is the USA's leading source of food and business-trend information and exclusive research on operators and restaurant patrons. Editorial coverage spans the entire foodservice industry, including chains, independent restaurants, hotels and institutions. To find out more about R&I,visit its website here >>

By the Editors

The bond between consumers and foodservice remains vital, strong and complex, but it cannot be taken for granted.

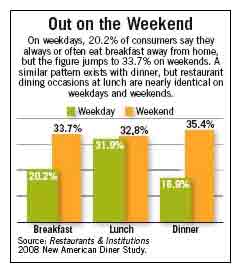

R&I's 2008 New American Diner Study finds that away-from-home dining continues to occupy an important place in Americans' increasingly busy lives. The average adult purchases a meal or snack outside the home 3.72 times each week. Nearly one-third (31.9%) of respondents say that on weekdays they always or often purchase lunch from a foodservice operation, compared with 20.2% who do so at breakfast and 16.9% who always/often do so during the week at dinner.

Dinner occasions rise sharply on weekends, and consumers are more inclined to try new foods and new restaurants when the workweek is over.

Additionally, consumers' interest in exploring ethnic cuisines and in healthful menu options continues to grow.

Away-from-home meals provide valuable convenience: 46.2% of those who purchase weekday breakfasts, for example, say their primary reason for doing so is a lack of time to prepare and eat food at home. But dining out is far more than simply "handy"; it is a valued way to share time with family and friends and a treasured treat or indulgence. Many diners (44.3%) say they strongly agree that enjoying a dinner away from home "is as much about the experience as about the food."

The tie between consumers and foodservice has become an important phenomenon of daily life, but it is not unbreakable. Diners expect high-quality food and service, and they want to feel that they receive value for the money they spend. Nearly one-third of diners say they strongly agree that price range is the first variable they consider in choosing a dining destination.

Some key insights from the 2008 New American Diner Study are included in this report and are presented to help operators better understand consumers' needs and expectations in the year ahead.

Weekday vs. Weekend Whereas filling seats on the weekend isn't usually a problem for restaurants, keeping business brisk during the week often is. So what are consumers looking for in particular during the week? The simple answer, it seems, is "cheaper and easier."

Participants in the New American Diner Study say that lower prices, discounts for frequent/loyal customers and more-convenient locations are the top things restaurants could offer to lure them to the dining room or the drivethru window more often on weekdays.

Diners in the survey say they are most inclined to use a weekend dinner as an opportunity to try a restaurant they have never been to. More than four in 10 diners (44.3%) say they're most likely to visit a restaurant that's new to them during this time, versus 11.3% who say they're most likely to visit a restaurant for the first time for a weekday dinner. Could weekday dinner promotions such as wine specials, appetizer discounts or fixed-price dinners get more diners through the doors on workdays? Quite possibly, as nearly 60% of diners are looking first and foremost for lower prices at dinner.

| Boomer Buy-In Just more than 62%57.0% than to matures' 80.8%. But only 14.2% of boomers (versus 27.2% of Gen Xers and 8.1% of matures) say they always or often get breakfast at or from a quick- or full-service restaurant on weekdays. That's a gap between the number of workers in a huge demographic group who are open to getting breakfast away from home during the week and those who actually do turn regularly to restaurants in the morning. |

| MAKING SENSE OF MATURES' DINING HABITS Matures are more likely than members of any other age group to say that they would be most inclined to try a new restaurant or a new dish for a weekday dinner. Older diners also have a particularly positive attitude toward the concept of a midweek restaurant dinner as a social occasion. Approximately 43% of matures cite an interest in sharing dinner with family, friends or co-workers as a reason they would eat dinner out during the week (versus 28.6% of Gen Y diners). |

| THE PRICE IS RIGHT44.6% Percent of diners who say that lower prices would most strongly persuade them to eat breakfast away from home on weekdays. Cost is even more influential in persuading diners to eat lunch (53.2% say lower prices would persuade them to dine out more) or dinner (59.5%) on weekdays. |

| SHAKE IT UP 47.2% Percent of diners who say that when having dinner at or from a restaurant on weekdays, they always or often order something different from what they would prepare at home. |

Time/Convenience

The opportunity to gather around tables with friends and family and share good meals prepared by someone else no doubt drives plenty of consumers out of their kitchens and into restaurants. When it comes to choosing where, when and how to dine out, though, convenience is king.

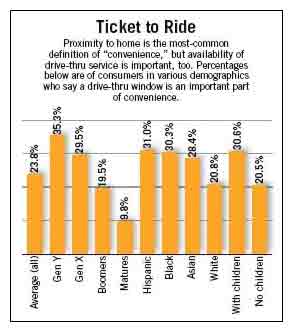

A staggering 80% of consumers make weekday dining decisions most or some of the time based primarily on convenience, according to R&I's 2008 New American Diner Study. Even on weekends, when meals likely are more leisurely, 73% still base restaurant-dining decisions primarily on convenience most or some of the time. Moreover, these findings vary surprisingly little by demographics such as age, race or the presence of children.

Because consumers are a diverse lot, they define convenience in multiple ways. Their top-three most-important factors are "located close to home," "dining experience is quick" and "easy to find/ free parking."

| Time on Your Side? Time is tied closely to convenience in consumers' minds, with nearly one-third of diners pointing to "quick dining experiences" as a factor when they select restaurants based on convenience. Moreover, time issues also strongly influence why people dine out: "time constraints/faster/don't have time to prepare" ranks first among reasons consumers eat breakfast, lunch or dinner at quick-service or full-service restaurants during the week. - Asian and black consumers equate time with convenience even more, with 46% and 37%, respectively, citing "quick dining experiences" among their top definitions of convenience. - Although more than 40% of consumers say time issues drive their decisions to eat out on weekdays, this figure is significantly higher among Gen Y, Gen X, singles and nonwhite respondents as well as among persons who have children. |

| PEOPLE WHO LIKE PEOPLE 28.4% Percent of Gen Y consumers who strongly like technology that enables them to place orders or pay for meals without dealing with counter workers. Support drops to 18.1% for Gen X members, 12.1% for baby boomers and 7.5% for matures. |

| Location Matters *R&I's* New American Diner Study once again emphasizes how crucial location can be to operators' success. Not only is "located close to my home" consumers' most commonly cited criterion for convenience by far, but also 47% of consumers rank it as the most-important factor. Telling, too, is that when asked what would make them more likely to eat at restaurants during the week, "restaurant locations more convenient to work, home or regular activities" proved a factor for one-third of respondents at breakfast, 38% at lunch and 34% at dinner. |

| GOING THE DISTANCE 10 to 19 Number of miles the plurality of consumers (35%) are willing to travel when choosing a restaurant; 29% will travel 20 to 29 miles. Males, singles, Asians, blacks, Hispanics and those earning less than $20,000 are more likely than other groups to want to travel less than 10 miles to get to a restaurant. When dining out on weekends versus weekdays, 78% are willing to travel farther, once again emphasizing the influence of busy schedules on dining habits. |

Make It Special

With some consumers saying they're cutting back on dining out because of rising gas prices and a host of other concerns, each restaurant experience needs to stand out in some way to prompt diners to visit the restaurant again. Operators must offer something that inspires in guests confidence in their selection of the establishment and that warm-and-fuzzy feeling that will entice them to return.

Consumers gave a mean score of 5.13 on a scale of 1 (strongly disagree) to 7 (strongly agree) when asked whether they agree with the statement "Eating out for dinner is as much about the experience as about the food." Unsurprisingly, the 40-and-younger crowd-wired and in tune with the celebrity-chef culture-has a significantly greater preference than older consumers for restaurants that have background music and restaurants where the chef comes out to talk to diners.

Generally, however, diners prefer a menu that reflects both familiar options and new tastes; the mean score for the statement "I like a menu to have a mixture of foods I know and foods I have never tried" was 5.07. Agreement was higher among Gen X and Gen Y diners and women, and lower among men, matures, white diners and Midwest diners.

| TALK TO ME 29% Percent of Gen Y consumers (compared with 17.8% of boomers) who say they like to go to restaurants where the chef talks with guests. |

| TUNED IN AND TURNED ON Gen X and Gen Y diners, predictably, are significantly more likely than boomers and matures to say that they often check a restaurant's menu on the Internet before they dine at or order from the restaurant. But they also are more likely than boomers and matures to agree that often they will try a restaurant if they see or hear a positive review of the establishment in a newspaper, on the radio or on television. |

| STARRY EYES 9.3% Percent of diners who strongly agree that they are more likely to choose a restaurant if a well-known chef owns it. |

| AN HOUR-LONG WAIT? NO THANKS! 5.01 On a scale of 1 (strongly disagree) to 7 (strongly agree), consumers' mean response to the statement "I won't wait longer than 30 minutes to be seated if there is a waiting list." Boomers and matures were less likely to say they'd wait. |

My Way

Sauce on the side. More beef. No bread. By heeding special requests, operators build loyalty and repeat business. How much customization do diners expect? Having a meal "my way" means many things, and there's no single item on a menu that signals to diners that they'll get what they're looking for.

Instead, there are several ways to convey the message. The 2008 New American Diner Study turns up a few surprising finds. Although the organic and local food movement is gaining steam, most consumers remain more interested in buying what tastes good. Nearly two out of every three consumers disagree with the statement: "I like menus that tell what farm or producer a particular food or ingredient comes from."

Yet among Gen Y diners, 22.5% are more likely to choose a dish if they know where the ingredients came from. In this way, younger diners are making a statement about who they are and what they want.

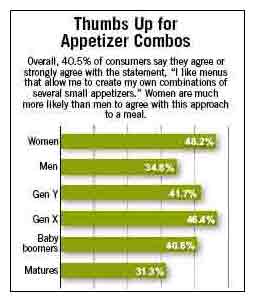

So whether it's nutrition information, choice in language, or customizable appetizer orders, consumers look to patronize restaurants that reflect their personality and give them the flexibility to have their food their way.

| Young and Restless Younger diners are far more comfortable than older diners with customizing their orders. About a quarter of both Gen X and Gen Y diners say they often ask to make changes to menu items they order. In contrast, only 14.5% of mature diners say they make changes to their orders. Mature diners are also at odds with entrée preferences shared by young and middle-aged diners. Whereas nearly half of young and middle-aged diners like menus that allow guests to create combinations of small entrées for their meal, less than a third of mature diners say they prefer this style. |

| MORE HEALTHY HABITS 32.9% Percent of diners who agree that they like menus that provide nutrition information for items- up from 21.3% in the 2007 New American Diner study. Gen X, women and Hispanic diners are especially interested in seeing such information. In contrast, only 13.9% of diners say they don't like menus that offer nutrition information. This represents a drop from last year, when 20.3% of respondents expressed a strong dislike for menus that supply nutrition information. So although most diners remain ambivalent on the issue, a growing number are interested in using foodserviceprovided nutritional information to help them make healthy choices when they dine out. |

| OLD AND NEW 43.5% Percent of consumers who strongly agree that they like menus on which they find a mix of familiar and never-tried dishes. Gen X (49%) and Hispanic diners (48.5%) are especially strong in their love of new-and-familiar menus. |

Dayparts

Not surprisingly, time and money are the prime motivators for dining away from home at breakfast, lunch and dinner. The New American Diner Study asked consumers why they choose to eat away from home and the No. 1 answer for each of the three main dayparts is that dining out is faster than preparing a meal at home.

Consumers also were asked what would persuade them to dine out more often and the top answer for all three dayparts is "lower prices." However, more-convenient locations rank second in persuasiveness.

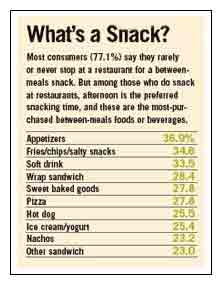

Breakfast continues to be foodservice's greatest opportunity because nearly onethird (31.1%) of consumers say they always or often skip a morning meal entirely. Snack occasions are another area of opportunity because the data shows that although consumers are frequent snackers, they don't often visit restaurants to satisfy their hunger.

The New American Diner Study also confirms that young adults (Gen Y) are most likely to be away-from-home diners at all three main dayparts.

| Where's Dinner? More than half (52.5%) of consumers say they sometimes purchase dinner from a quick- or full-service restaurant on weekdays; 14% say they often do, and 2.8% say they always buy dinner away from home. The percentages below are of consumers who say they always or often eat their dinners away from home in the following manners. 14% - Takeout dinner eaten in the car 20.9% - Takeout dinner eaten at home 12.2% - Dinner delivered by a restaurant and eaten at home 36.2% - Dinner eaten in a restaurant with friends or family 8.9% - Dinner eaten in a restaurant for business purposes |

| Young Metabolisms Younger consumers tend to be the heaviest between-meals snackers, and men are more likely than women to grab a snack. Numbers below represent the average number of snacks each week that various demographic groups say they purchase away from home. Women - 2.5 Men - 3.2 Gen Y - 4.1 Gen X - 3.3 Baby boomers - 2.5 Matures - 1.4 |

| FAST BREAK 36 Average number of minutes consumers say they take for a weekday lunch break, which explains why picking up a quick meal at a drive-thru window is so popular. Gen Y consumers take the shortest average break (33.2 minutes); those age 61 or older enjoy the longest lunches, although even for these consumers the midday break averages only 37.4 minutes. The higher a person's income, the longer the lunch break. Consumers with a household income of less than $20,000 average a 33-minute lunch; for those with a household income above $100,000, lunch breaks average 40 minutes. |

| The Car as Diner Consumers who eat meals away from home still are most likely to enjoy those meals in a restaurant, but eating meals in the car while driving is common, too, especially at breakfast. Percentages below are of consumers who say they always or often pick up a meal at a drive-thru window to eat in their car. Women MenBreakfast 23.2% 23.0% Lunch 18.7% 18.7% Dinner 13.1% 15.0% |