How mobile payment apps will shake up hospitality

Now that Apple Pay is set to shake up the mobile payment scene, Elly Earls discovers the ways these apps could prove seismic for hospitality

Mobile payment solutions are still very new in the UK's hospitality sector. They range from apps like Velocity, Zapper and Flypay to software that allows customers to pay via their phones without even having to download an app - like Wi-Q, and, of course, the much-hyped Apple Pay. Apple Pay launched here in July, and even the most established mobile payment app providers have been around for only a couple of years at most. But even at this early stage, both operators and suppliers are convinced mobile payments are here to stay.

Benefits set to drive growth

For Tom Weaver, chief executive of mobile payment app provider Flypay, the figures speak for themselves. "Flypay has seen growth from a zero start when we were founded in 2013 to processing a regular 15%-25% of transactions at engaged sites," he says. "We're experiencing exponential growth at the moment, and we see this continuing as we increase the number of operators we work with."

Zia Yusuf, co-founder of competitor Velocity, agrees. "One-third of Starbucks' North American revenues already run through their mobile app and we anticipate the hospitality spectrum to move to that sort of adoption over the coming five years," he says. "What we are finding is that when customers are empowered to view, pay their bill on their phone and leave, they don't want to go back to the old way. That's why a third of our transactions are already from repeat customers."

This is hardly surprising, given that the part of the meal experience that customers are generally most dissatisfied with - according to both research and anecdotal evidence from restaurateurs - is paying the bill. "The feedback we get from consumers is that they love their experience at [our client restaurants] but if they have a bad 10 minutes at the end of the night where they have a tough time getting or processing the bill, it can take away from the overall quality of the night," says David Saenz, co-founder and chief executive of Uncover, which originally launched as an app to help customers find and book London's most desirable restaurants at the last minute, but now also offers mobile payments.

Mobile payment apps can solve this problem, as Dylan Murray, operations director at Drake and Morgan has discovered since working with Flypay. "Since introducing their pay-at-table technology across our portfolio, we've been able to dramatically reduce the payment process for customers from an average of 10.2 minutes to under a minute," he says.

And it's not only customers that are seeing the benefits of mobile payments. They're a boon for operators, too, not only because their customers are happier after paying their bills faster and enjoying staff members' increased focus on customer service, but also because they're seating more customers and learning more about them.

Mobile app provider Zapper, for example, offers its customers access to an online dashboard and customer relationship management, which gives restaurateurs all the details of their mobile payments, helping them work out who their VIP customers are.

"Through a simple mobile payment, restaurants can extract all kinds of insights on their diners and use this information to bring back customers to their venue and reward loyalty," explains UK chief executive Gerry Hooper. "Once they understand the power beyond the mobile app payment - the customer insights recorded, and the in-app marketing platform - restaurants see the clear benefit. Hence, we are growing our estate of Zapper restaurants by approximately 200 new venues a month."

Customer spend also tends to increase significantly when bills are paid by mobile. "What's interesting is that the average Zapper bill is 20% higher than a standard bill. In some cases we are seeing a 40% increase on average spend," Hooper says.

Meanwhile, one of the unexpected benefits Flypay customers have noticed is that those who pay by mobile are tipping more. "Flypay technology is hugely popular with front-of-house teams as tips are often above the industry average of 9% - Flypay tippers leave on average 12.43%," says Weaver.

The Zapper app allows customers to pay by scanning in a QR code on their receipt

Early adopter trends

Unsurprisingly, operators are seeing most mobile payment transactions taking place during their restaurants' busiest periods, where time really is of the essence.

"It's during these busiest times that restaurants get the most benefit from the service, as their waiters spend less time administering bills and are freed up to spend more time taking orders and delivering a great service," Yusuf explains. "Tables are turned quicker as a result, allowing them to seat more diners."

Flypay has found that 40% of transactions through the app take place between midday and 2pm and just over half of all transactions go through at dinner time.

It has also been observed by both restaurateurs and suppliers that it is the younger generation that are making the most of mobile payments - at least at present.

"The demographic we've seen the most are the mid-20s to mid-30s, but typically the early technology adopter demographic is within that age group. They are wired to try new things through their interest in the technology and that is what generates the imperative to try a payment app," says Wi-Q chief executive Graham Cornhill.

Yet, as confidence builds in the technology, more age groups are set to get on board with paying with their phone; in fact, many operators have already seen a surprising spread of users. "We've found that on the majority of tables, at least one guest will have a mobile device, so it's popular across all ages. The sheer convenience and time-saving aspect of being able to order from the table has benefits for every customer, from business users in a hurry to young families who have children they don't want to leave at the table while they queue up to order," says Wi-Q client John Gowing, manager at the Lion Inn in Boreham, adding that the venue is already seeing a huge increase in the number of "silver surfers" coming in with tablets and mobiles.

"Market research we've done at Uncover suggests this is a product not just limited to young, technology-inclined people," agrees Saenz. "It's a great technology for business travellers, for example, men and women that are aged 30 to 50, because they can now get all their receipts in one app, making it easier to forward on receipts for reimbursement at the end of a business trip."

Potential challenges

Cornhill anticipates that front-of-house staff will find it most difficult to adapt to mobile payments.

"Back-office staff will love it as it is time back to them at the end of the day and one less payment slip to total up and balance back. The biggest battleground in payment is tips; most frontline staff see PDQs and other payment methods as tip-killers - sadly that's not correct when done properly," he says. "But as with most change implementations, unless all the staff are well-trained in all methods of payment and how to handle them when they go wrong, I think frontline staff will back away."

The Lion Inn overcame this potential challenge by making sure each and every member of staff was involved in the system's implementation from the outset.

"We implemented Wi-Q in consultation with our staff and delivered extensive training and testing, so they were engaged in the process from day one," Gowing explains.

"Wi-Q has ended the frustration of long queues at the order point, which our front-of-house staff have previously had to manage and could be incredibly challenging at peak times. Now our customers have an alternative and don't have to queue if they don't want to; as far as our service team is concerned, if the customers are happy, they are delighted."

Restaurateurs make wholesale orders via apps

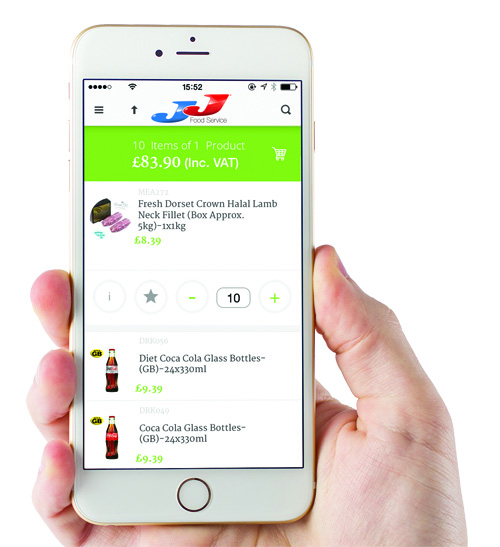

It's not just diners that are increasingly benefiting from mobile apps; now restaurateurs can too, thanks to wholesaler JJ Food Service's smart ordering app that can predict what they might want to order.

"We used the Microsoft Azure recommendation engine, which has been trained with three years' worth of transactional data. As a result, the new app can make suggestions based on previous shopping habits, resulting in a more efficient shop," explains Mushtaque Ahmed, chief operating officer at JJ Food Service. "Now customers can place an order in seconds."

It wasn't an easy solution to develop, though, Ahmed admits. "By the time we'd finished the first version of the app it was already out of date! We overcame the challenge by constantly monitoring and improving it."

The company has also seen a significant increase in spend. "For every 100 frequently-bought-together recommendations, 20 are purchased. For every 100 items that are recommended at the checkout, five are purchased. That's an excellent conversion rate."

Wagamama rolls out Apple Pay

By July, Japanese-inspired restaurant group Wagamama had already signed up around 70,000 customers to the Qkr mobile payment app, which allows users to pay and leave without waving down a waiter.

But the group still wasn't satisfied it was giving its customers quite enough choice on how to pay.

Enter Apple Pay. Now available at all Wagamama outlets across the country after the group became one of the first UK restaurant groups to team up with Apple Pay for its UK launch, this solution will add yet another string to Wagamama's fast-expanding mobile payment bow.

"We really see it as another choice of ways to pay as not everyone wants to download an app," explains marketing director Alex Meyer. "Already, only 40% of our transactions are paid for in cash, so we see this as another way to erode that 40% even further."

Adding Apple into the mix, he hopes, will encourage more customers to make the switch to mobile payments. "With Apple Pay putting a big marketing campaign behind this in the next couple of months, we see people's awareness of mobile payment only growing."

Uncover

Although the Uncover app's mobile payment feature was only launched in July, Peruvian restaurants Lima and Lima Floral, two of the system's launch partners, had already carried out around 100 mobile transactions using the app before the launch - and managing director Gabriel Gonzalez couldn't be happier with the results.

"The industry is changing and becoming very technology-driven in many ways, without losing the human factor, of course. So we are trying to get on board with new things coming onto the market that can make the overall experience for our customers better. Uncover was a great partner to work with to achieve this," Gonzalez says.

"We want to focus on customer experience and this technology just makes the whole experience more seamless and enables staff to concentrate more on the customer."

The launch of Uncover's mobile payment engine means customers using the app can now find and book London restaurants via their iPhone as well as checking, splitting and paying their bill without a waiter.

"All the manual steps that used to take place to facilitate that transaction are now eliminated, so the waiter can really just focus on chatting to the diners and making sure they enjoy the experience," says David Saenz, co-founder and chief executive of Uncover.